Life Insurance Policy: The Unique Gift for Your Loved Ones

A life insurance policy is more than just a safety net; it can be an extraordinary gift that secures your loved ones’ financial future. Unlike typical presents such as gadgets or concert tickets, which can quickly lose their value, gifting life insurance provides lasting benefits for your family. By investing in a life insurance policy, you are not only demonstrating love and care but also ensuring that your children or partner have financial security when it matters most. Exploring the benefits of life insurance reveals how this financial tool can offer peace of mind and stability. From helping to cover college expenses to providing a safety net for unexpected challenges, a life insurance policy truly stands out as a thoughtful and impactful financial gift.

When considering alternative expressions to describe life insurance coverage, terms like financial protection and insurable gift can come to mind. Such policies exemplify the importance of prudent planning for the future, particularly for children. Young individuals often benefit from lower life insurance premiums, making it a wise financial move that can carry forward into adulthood. Offering a financial gift in the form of a life insurance policy not only secures insurability but also invests in long-term financial wellbeing. As we delve deeper into the nuances of these insurance products, their multifaceted advantages become clear, positioning them as valuable assets in family financial planning.

The Value of Gifting Life Insurance to Loved Ones

When it comes to gifting, the usual choices often revolve around physical items that can quickly lose their value or become obsolete. However, gifting a life insurance policy offers a unique advantage—it’s not merely a gift but a thoughtful investment in someone’s future. Unlike traditional gifts, a life insurance policy provides financial security and peace of mind. Such a practical gift signifies your commitment to their long-term welfare, demonstrating your deep concern for their well-being.

Furthermore, gifting a life insurance policy can serve as a lesson in financial responsibility. It allows you to pass on the importance of planning for the future, encouraging loved ones to understand financial products that can substantially impact their lives. This can help establish a foundation of financial literacy that can benefit them when making life decisions later on.

Understanding the Financial Benefits of Life Insurance Policies

Life insurance policies are often seen as a mere expense, but they provide tangible financial benefits that can extend into the future. For children especially, the cost of premiums is significantly lower at a young age, meaning you can lock in a lifetime rate while they are still healthy. This forms a safety net; as future financial responsibilities loom, knowing they have a life insurance policy can alleviate stress during challenging times.

Additionally, many life insurance policies build cash value over time. This accumulation can be a crucial financial resource for your child down the line—whether for educational pursuits, a wedding, or a first home purchase. By gifting a life insurance policy, you are not just giving a financial instrument, but also a means to achieve their dreams.

Why Life Insurance is an Ideal Choice for Children

The benefits of life insurance for children extend well beyond the initial premiums paid. Insurance is often more affordable for younger individuals, making it an economical decision for parents. Locking in these rates ensures their coverage remains consistent over time, regardless of future health developments that may hinder their insurability later.

This policy can also provide a foundation where your child learns about investments and the importance of financial planning. As they grow older, having a life insurance policy can serve not only as a safety net but also as a lesson that enhances their financial savvy, ensuring they are prepared for whatever life may throw their way.

How Life Insurance Provides Future Financial Security

Opting for a life insurance policy isn’t just about securing death benefits; it is about providing future financial security for your family. When you gift a life insurance policy, you’re ensuring that your loved ones can access financial resources to navigate life’s milestones, from education to homeownership.

These policies often come with cash value that accumulates over time, eventually allowing your loved ones to take withdrawals or loans against the policy. Such accessibility can empower them financially, giving them options when they need them the most—a critical safety net in an unpredictable world.

The Longevity of Life Insurance Gifts

While tangible gifts like electronics and toys can bring joy in the short term, their utility diminishes over time. In contrast, a life insurance policy can last through a lifetime, maintaining its value and significance long after it is gifted. The longevity of this financial instrument means it can serve generations, transitioning to an important asset as your loved ones navigate adult life.

Moreover, life insurance can offer long-term benefits, such as accumulating cash value and providing a safety net during emergencies. By gifting a life insurance policy, you create a lasting legacy that demonstrates love and foresight, ensuring that your loved ones are cared for even when you are not present.

The Role of Life Insurance in Financial Planning

Life insurance is a crucial component of any comprehensive financial plan. It ensures that your family’s needs are met should an unforeseen event occur. By incorporating life insurance into your financial gifts, you’re not just providing a present but also securing financial stability for your loved ones’ future.

A well-structured life insurance policy can transition into an estate planning tool, particularly when creating long-term financial strategies. Your financial advisor can help align this asset with other financial strategies to ensure that it complements your overall wealth management plan effectively.

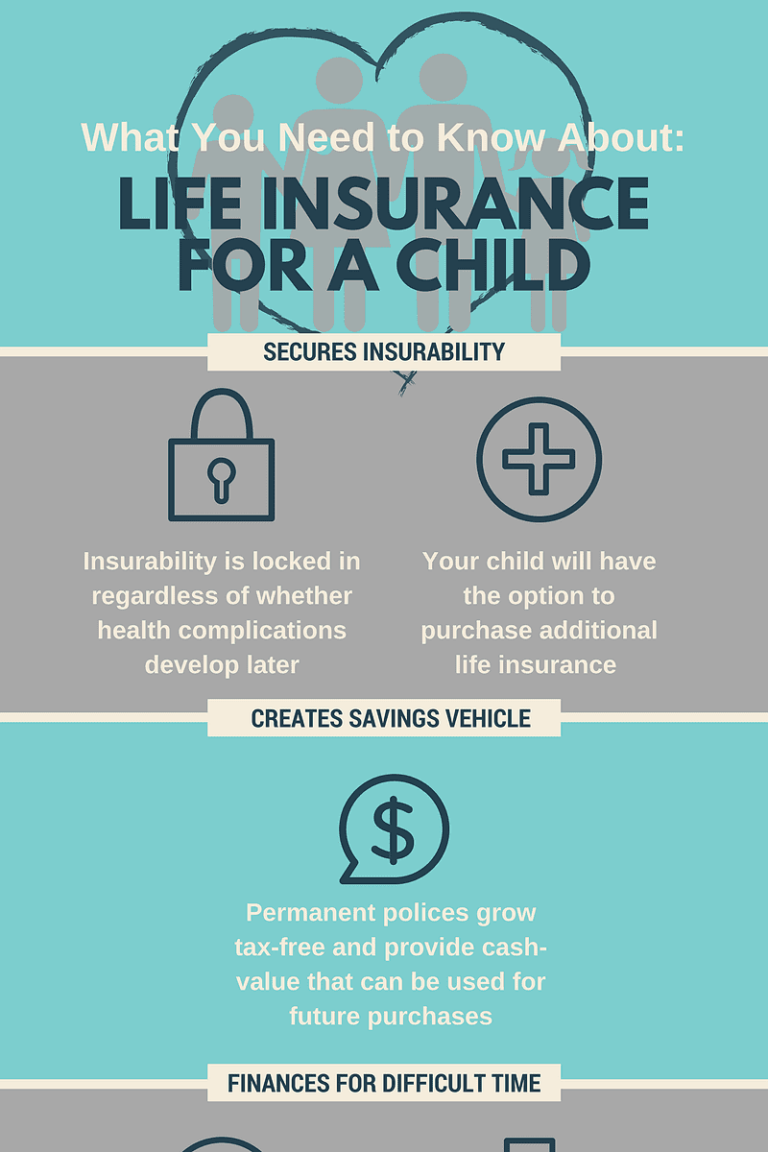

Securing Guaranteed Insurability for the Future

One of the unique advantages of purchasing life insurance for children is the guarantee of insurability. By setting them up with a policy at a young age, you protect them from future health issues that could inhibit their ability to acquire adequate coverage. Life is unpredictable, and securing a policy early shields them from the unknown.

Moreover, many life insurance policies provide options for increased coverage later on, allowing your children to expand their policy as their needs grow—typically without additional health checks. This feature reinforces the importance of early investment in life insurance, establishing a proactive approach to financial and health security.

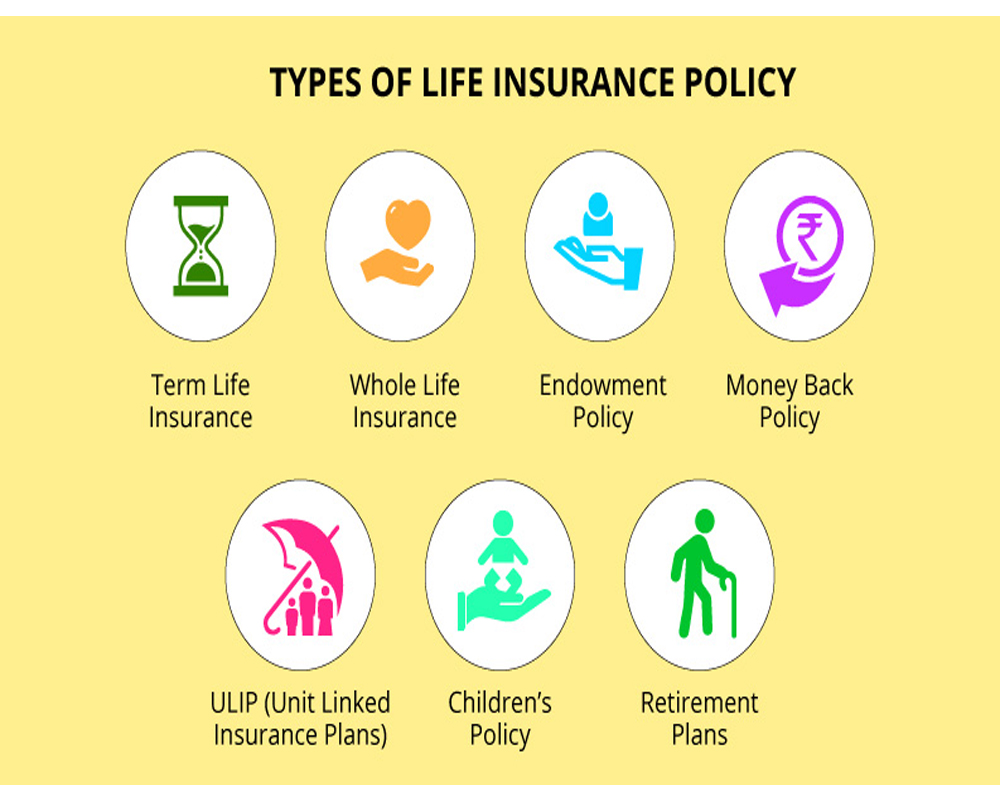

Informed Decisions: Choosing the Right Life Insurance Policy

When considering gifting a life insurance policy, it’s essential to evaluate the various options available to ensure you make an informed decision. Factors such as the type of policy, coverage limits, and premium costs should all play a significant role in your selection process. Consulting with a financial expert can provide valuable insights, ensuring you choose a policy that aligns with your family’s needs.

Additionally, it’s crucial to review the policy terms thoroughly. Different policies come with varying features, such as cash value growth and premium payment options. Understanding these details will equip you to make a well-rounded decision that can benefit your loved ones both now and in the future.

The Emotional Impact of Gifting Life Insurance

Gifting a life insurance policy can transcend mere financial practicality. It embodies a deep emotional commitment to your loved ones’ futures, a testament to your desire for their safety and well-being. This act fosters a sense of security and peace, knowing that they are covered in times of need.

The emotional value embedded in a life insurance policy can also serve as a conversation starter about finances. It encourages open dialogues surrounding financial literacy in families, creating a teaching moment for children about the importance of preparing for the unexpected, thus instilling wisdom and responsibility from an early age.

Frequently Asked Questions

What are the benefits of life insurance policies for children?

Life insurance policies for children provide several benefits including lower premiums due to their age and health, guaranteed insurability, and the potential to build cash value over time. These policies can act as a financial gift that helps secure your child’s future financial needs, such as college expenses, weddings, or even purchasing a home.

Is gifting life insurance a good idea for family members?

Yes, gifting a life insurance policy is a unique and thoughtful gesture that goes beyond traditional gifts. It shows you care about your loved ones’ long-term financial security and provides them with a financial asset that can be beneficial in the future.

How do life insurance premiums for children compare to adults?

Life insurance premiums for children are generally much lower than those for adults due to their youth and good health. This makes it an economical choice for parents looking to secure their children’s future. Additionally, children can potentially convert their policy to higher coverage without medical underwriting as they grow older.

Can I access the cash value of a life insurance policy for my children?

Yes, if the life insurance policy has a cash value component, you can access this amount for various needs, such as funding education or other significant life expenses. Keep in mind that any withdrawals will reduce both the policy’s cash value and death benefit.

How does life insurance provide guaranteed insurability for my children?

Purchasing a life insurance policy for your children ensures they are insured regardless of any future health issues that could make it difficult to qualify for coverage later in life. This protects their insurability while they are healthy.

What should I consider when choosing a life insurance policy as a financial gift?

When selecting a life insurance policy to gift, consider the coverage amount, premium costs, policy type, and additional benefits such as cash value accumulation. Consulting a financial expert can help ensure you choose the best option that aligns with your family’s financial goals.

| Key Point | Description |

|---|---|

| Sensible and Practical Idea | A life insurance policy reflects thoughtful care and financial responsibility for loved ones. |

| Lower Premiums for Children | Children often have lower premiums, making it more affordable to secure insurance early. |

| Funds for Future Needs | Life insurance cash value can help fund crucial life events, like education or buying a home. |

| Guaranteed Insurability | Purchasing while young avoids potential insurability issues that may arise later. |

Summary

A life insurance policy is a meaningful gift that goes beyond traditional presents. By considering this option, you are not only offering financial security but also demonstrating your deep care for your loved ones’ future well-being. As you explore your gifting choices this season, think about how a life insurance policy could be the most impactful way to invest in their financial health.