CRM Software: Top Benefits for Your Insurance Agency

In the fast-paced world of insurance, CRM software has emerged as an indispensable tool for agency owners striving to enhance their operations. This customer relationship management system streamlines processes, consolidating client interactions, sales data, and marketing efforts into one user-friendly platform. By adopting effective CRM solutions, insurance agencies can unlock numerous benefits, including improved customer service, increased sales, and actionable insights that drive growth. With the right CRM software, agencies can tailor their services to meet client needs, fostering long-lasting relationships and loyalty. As we delve into the top ten advantages of CRM software for insurance agencies, you’ll discover how these systems can transform your business and set you on the path to success.

Customer relationship management solutions, often referred to as agency management systems or insurance agency software, are designed to optimize the way businesses interact with their clients. These systems offer a comprehensive suite of features aimed at enhancing efficiency and productivity in managing customer relationships. By leveraging the capabilities of specialized software, insurance companies can not only improve their service delivery but also gain valuable insights into customer behaviors and preferences. As the market for best CRM for agencies expands, understanding how these tools can benefit your operations becomes increasingly important. In this exploration, we will highlight the key benefits that come with implementing an effective Insurance CRM system.

Understanding CRM Software in the Insurance Industry

CRM software, or Customer Relationship Management software, plays a crucial role in the insurance industry by helping agencies streamline their operations and enhance customer interactions. With features like contact management, sales tracking, and automated marketing, CRM systems allow insurance agents to efficiently manage client relationships. By centralizing customer data, agents can access vital information quickly, leading to improved service delivery and client satisfaction.

In the fast-paced world of insurance, having a robust CRM system can differentiate successful agencies from the competition. These systems not only help agents track client interactions but also provide insights into customer behavior and preferences. This data can inform marketing strategies and product offerings, ensuring that agencies meet the evolving needs of their clients. The right CRM software can thus be an invaluable asset in driving business growth and enhancing customer loyalty.

Top Benefits of CRM Software for Insurance Agencies

The adoption of CRM software offers numerous benefits for insurance agencies. One of the most significant advantages is improved customer service. With a centralized database of customer information, agents can respond to inquiries quickly and resolve issues more efficiently. This level of customer care fosters trust and satisfaction, leading to long-term client relationships. Moreover, CRM systems can help identify common customer issues, allowing agencies to refine their services proactively.

In addition to enhancing customer service, CRM software can significantly increase sales for insurance agencies. By analyzing customer data, agents can identify upselling and cross-selling opportunities, guiding targeted marketing efforts. This strategic approach not only boosts sales but also helps agents manage their pipelines more effectively. As a result, agencies can achieve higher sales conversion rates and maximize their revenue potential.

Improved Customer Insights with Insurance CRM Systems

Insurance CRM systems provide agents with detailed insights into customer profiles, enabling more personalized service and targeted marketing campaigns. By analyzing data such as purchase history and client interactions, agencies can better understand their customers’ needs and preferences. This knowledge allows agents to tailor their communications and offerings, resulting in a more meaningful engagement with clients.

Furthermore, these systems empower insurance agencies to segment their customer base effectively. By categorizing clients according to various criteria such as demographics or buying behavior, agencies can implement focused marketing strategies that resonate with specific groups. This enhanced understanding of customer segments not only improves marketing efficiency but also drives higher customer satisfaction and retention rates.

Enhancing Productivity and Efficiency with CRM Solutions

One of the standout features of CRM solutions is their ability to enhance productivity and efficiency within insurance agencies. By centralizing customer information, agents can quickly access the data they need without wasting time searching for scattered documents. This streamlined workflow allows teams to focus on high-impact tasks rather than administrative duties, ultimately leading to increased productivity.

Moreover, CRM systems often include automation features that can handle repetitive tasks such as sending follow-up emails or scheduling appointments. This automation frees up valuable time for agents, enabling them to concentrate on building relationships with clients and closing sales. By leveraging CRM technology, insurance agencies can optimize their operations and achieve greater efficiency, making it easier to manage a growing client base.

The Role of Data Dashboards in Insurance CRM Systems

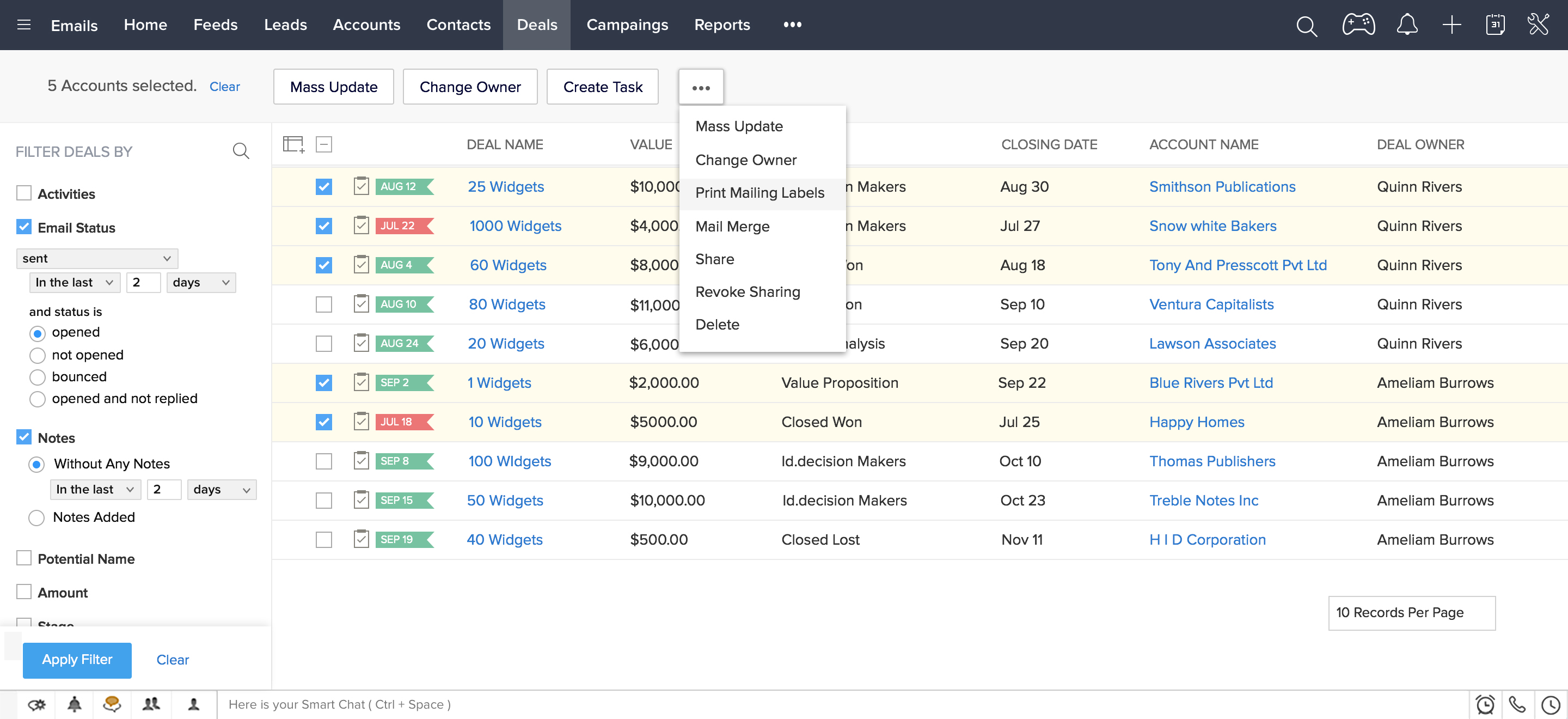

Data dashboards are a critical component of modern CRM systems, providing insurance agencies with real-time insights into their performance metrics. These visual tools allow agents to monitor key performance indicators (KPIs) at a glance, facilitating data-driven decision-making. Whether tracking sales figures, customer satisfaction scores, or marketing campaign effectiveness, data dashboards empower agencies to respond quickly to emerging trends and adjust their strategies accordingly.

Additionally, actionable data dashboards enable agencies to create custom reports that align with their specific business objectives. By visualizing data in an easily digestible format, these dashboards help teams identify strengths and weaknesses within their operations. Consequently, agencies can implement targeted improvements that drive profitability and enhance overall business performance.

Managing Customer Communications Effectively with CRM

Effective communication is essential in the insurance industry, and CRM systems excel in managing all forms of customer contact. By consolidating emails, phone calls, and social media interactions into a single platform, agents can keep track of client communications efficiently. This organization ensures that no customer inquiry goes unanswered and that follow-ups are timely, ultimately leading to improved customer satisfaction.

Moreover, CRM software often includes automation features that streamline customer communication processes. For instance, automated reminders can alert agents to follow up with clients after a policy renewal or a claim submission. By managing communications proactively, insurance agencies can enhance their client relationships and foster loyalty, which is vital in a competitive market.

Segmentation and Targeting with Insurance Agency Software

Segmentation is a powerful strategy that insurance agencies can leverage through their CRM software. By categorizing clients into specific groups based on demographics, buying behaviors, and preferences, agencies can tailor their marketing efforts to resonate with each segment. This targeted approach not only increases the effectiveness of marketing campaigns but also ensures that clients receive relevant information that meets their needs.

Additionally, effective segmentation allows for better resource allocation within the agency. By understanding which customer segments are most profitable, agencies can focus their marketing budgets and sales efforts on those areas. This strategic targeting can lead to improved conversion rates and higher overall profitability for the agency, highlighting the importance of utilizing CRM systems for informed decision-making.

Maximizing Customer Retention with CRM Systems

Customer retention is a key focus for insurance agencies, and CRM systems play an essential role in this area. By monitoring customer interactions and satisfaction levels, agencies can identify potential issues before they escalate. Early intervention can prevent customer churn and ensure that clients feel valued and appreciated throughout their relationship with the agency.

Moreover, CRM systems provide valuable insights into customer behavior and preferences, allowing agencies to personalize their offerings effectively. By understanding what drives customer loyalty, agencies can implement targeted strategies that enhance satisfaction and encourage repeat business. This proactive approach to customer retention not only stabilizes revenue but also fosters a loyal client base.

Automated Reporting for Strategic Insights in Insurance CRM

Automated reporting is a game-changing feature of CRM systems that can save insurance agencies valuable time and resources. By generating regular reports on key metrics such as sales performance and customer satisfaction, agencies can gain insights into their operations without manual data entry. This level of efficiency allows teams to focus on analysis and strategy rather than getting bogged down by administrative tasks.

Additionally, automated reports can highlight trends and areas for improvement, providing actionable insights that inform strategic decision-making. By understanding performance patterns, insurance agencies can adjust their sales tactics and marketing campaigns to better align with customer expectations. This data-driven approach enhances competitiveness and supports sustainable growth within the agency.

Frequently Asked Questions

What are the key benefits of using CRM software for insurance agencies?

CRM software provides numerous benefits for insurance agencies, including improved customer service, increased sales opportunities through better targeting, enhanced customer retention, and actionable data dashboards for informed decision-making. By centralizing customer information, CRM systems help streamline processes, allowing agencies to focus on growth.

How can CRM systems enhance customer relationship management in insurance?

CRM systems enhance customer relationship management in insurance by providing a comprehensive view of customer interactions and history. This enables agents to personalize communication, anticipate client needs, and proactively address issues, ultimately leading to higher customer satisfaction and loyalty.

What features should I look for in the best CRM for agencies?

When looking for the best CRM for agencies, consider features such as contact management, sales and marketing automation, reporting and analytics, task management, and effective communication tools. A CRM that integrates seamlessly with existing systems and provides customizable dashboards will also be advantageous.

How does Insurance CRM software improve sales performance?

Insurance CRM software improves sales performance by offering insights into customer behavior and sales trends, enabling targeted marketing campaigns and effective upselling strategies. With a clear view of the sales pipeline, agents can track leads and conversions, ensuring they capitalize on every opportunity.

What role does CRM software play in customer retention for insurance agencies?

CRM software plays a critical role in customer retention for insurance agencies by allowing for consistent engagement and follow-ups with clients. By monitoring customer satisfaction and addressing concerns promptly, agencies can foster long-term relationships and reduce churn rates.

Can CRM systems help with compliance in insurance agencies?

Yes, CRM systems can significantly help with compliance in insurance agencies by maintaining accurate records of client interactions and transactions. This ensures that agencies meet regulatory requirements and can easily access necessary documentation during audits.

What makes InsuredMine CRM a top choice for insurance agencies?

InsuredMine CRM is a top choice for insurance agencies due to its specialized features tailored to the insurance industry, such as integrated communication tools, automated reports, and robust customer insights. It enhances efficiency and productivity, making it easier to scale the business.

How do I choose the right CRM software for my insurance agency?

To choose the right CRM software for your insurance agency, assess your specific needs, budget, and desired features. Look for user-friendly interfaces, customization options, and integration capabilities with other tools. Also, consider seeking demos or trials to evaluate functionality before making a decision.

What types of insurance agencies can benefit from CRM systems?

All types of insurance agencies, including those specializing in health, auto, life, and property insurance, can benefit from CRM systems. These tools help agencies of any size enhance customer relationships, streamline operations, and drive sales.

How can CRM software help automate tasks for insurance agents?

CRM software helps automate tasks for insurance agents by streamlining repetitive processes, such as follow-up emails, appointment scheduling, and report generation. This automation frees up agents’ time, allowing them to focus on building relationships and closing deals.

| Key Benefits | Description |

|---|---|

| Better Customer Service | Centralizes client information for quick issue resolution and enhanced service. |

| Increased Sales | Identifies upselling opportunities and improves sales forecasting. |

| Cross-Functional Insights and Reporting | Provides a holistic view for better decision-making across departments. |

| Improved Customer Retention | Enhances satisfaction and loyalty by identifying and solving issues early. |

| Actionable Data Dashboards | Offers real-time insights for swift and effective decision-making. |

| Better Segmentation | Allows targeted marketing by categorizing customers based on needs. |

| Better Knowledge of Customers | Provides insights into customer needs, helping to tailor offerings. |

| Higher Productivity and Efficiency | Centralizes information for efficient workflows and task automation. |

| Managed Communications | Centralizes customer communications for better service and responsiveness. |

| Automated Reports | Generates reports automatically to track progress and identify trends. |

Summary

CRM software is essential for insurance agencies looking to enhance their operations and drive growth. By utilizing a CRM system, agencies can improve customer service, increase sales, and gain valuable insights through actionable data dashboards. The advantages of CRM software, such as better customer retention and higher productivity, make it a vital tool for success. If your insurance agency has not yet adopted a CRM system, consider implementing one today to stay competitive and foster long-lasting relationships with your clients.