Personal Auto Policy for Business: What You Need to Know

A personal auto policy is an essential insurance option for individuals who use their vehicles for both personal and business purposes. As the trend of entrepreneurship continues to rise, many people find themselves navigating the complexities of auto insurance coverage tailored specifically for their needs. Understanding how a personal auto policy works can save business owners money while ensuring they have adequate protection for their vehicles. This policy is particularly useful for professionals like real estate agents and consultants who may not require extensive commercial auto coverage. Additionally, with the rise of ridesharing services, many auto insurance providers are now offering specific endorsements that cater to these unique vehicle use situations.

When discussing vehicle insurance for personal and business use, terms like personal vehicle coverage and business use insurance often come into play. Many entrepreneurs are unaware that their everyday car insurance can potentially cover their business activities, especially if those activities do not involve significant changes to the vehicle’s use. For instance, professionals such as lawyers and doctors might rely on a straightforward personal auto policy rather than seeking a commercial auto policy. This approach provides necessary insurance protection without the higher costs often associated with commercial insurance. It’s crucial to assess your vehicle’s usage and consider factors like ridesharing or deliveries to ensure proper vehicle use insurance is in place.

Understanding Personal Auto Policy for Business Use

A personal auto policy (PAP) can often serve as a convenient solution for small business owners who occasionally use their personal vehicles for work purposes. Many entrepreneurs, such as real estate agents, consultants, and sales representatives, find that their day-to-day operations can be effectively managed with their personal vehicles without needing a separate commercial auto policy. This approach not only streamlines insurance management but can also save on costs associated with premium payments for commercial coverage.

However, it is essential to understand the limitations of a personal auto policy when it comes to business use. While it can cover certain business-related activities, it may not provide adequate protection in cases of significant liability claims or accidents that occur while transporting goods or services. Therefore, business owners should carefully evaluate their vehicle use and consider transitioning to a commercial auto policy if their operations expand or if they frequently transport clients or goods.

Who Qualifies for Coverage Under a Personal Auto Policy?

Typically, a personal auto policy is designed to cover individuals and their immediate family members. For business owners, this means that if they or their household members are the primary users of the vehicle and are not involved in transporting goods for hire, they may qualify for coverage under a personal auto policy. This includes professions like consulting and legal practices where personal vehicles are used for client meetings or travel.

However, as soon as employees begin to operate the vehicle for business purposes, or if the business involves more extensive use, such as delivery services, it is advisable to consider a commercial auto policy. This ensures that there is adequate coverage for all potential liabilities, especially when employees are driving company vehicles. Additionally, vehicles exceeding 10,000 pounds are typically excluded from personal auto policies, necessitating a commercial policy for those larger vehicles.

The Importance of Vehicle Use in Insurance Coverage

The way a vehicle is used significantly affects the type of insurance coverage required. If the vehicle is primarily used for personal errands, a personal auto policy may suffice. However, if the vehicle is used for any form of delivery or transportation for hire, such as ridesharing services, then a commercial auto policy becomes necessary. Insurers view these activities as higher risk, and therefore, they mandate more comprehensive coverage to protect against potential liabilities.

For instance, while using a vehicle for ridesharing with companies like Uber or Lyft might seem like a personal use, many insurance providers offer specific endorsements for personal auto policies to cater to this growing need. It’s crucial for drivers to consult with their insurance agents to ensure that they have the correct endorsements or policies in place to cover these business-related activities, thereby avoiding gaps in coverage that could lead to significant financial losses.

Navigating Company Vehicles and Personal Auto Policies

In many cases, businesses provide employees with vehicles for both personal and professional use. When this occurs, the vehicle is generally covered under the company’s commercial auto policy, which is designed to address higher liability risks associated with business operations. Employees should always confirm the specifics of coverage with their employer and understand the implications of using a company vehicle for personal errands.

However, it can be beneficial for employees to also have a personal auto policy as a supplementary layer of protection. By securing an add-on endorsement, they can enhance their coverage and ensure they are protected in all scenarios, including personal use of the vehicle. This dual coverage can be particularly important in the event of accidents or incidents that occur while the vehicle is being used outside of work hours.

Exploring the Benefits of Central’s Auto Insurance Coverage

Central offers a variety of auto insurance coverages tailored to meet the diverse needs of business owners and personal drivers alike. From basic protection plans to more comprehensive options like the Signature Auto Policy, Central is committed to providing a wide range of choices that cater to different levels of vehicle use, including personal and commercial coverage. This flexibility ensures that customers can find a policy that aligns perfectly with their insurance requirements.

Additionally, Central’s personal auto policy includes valuable features such as 24/7 roadside assistance and various discounts that can help reduce overall insurance costs. By working with an independent agent, customers can explore these options and find the best policy that not only meets their specific needs but also maximizes their savings while maintaining adequate coverage.

Key Considerations for Ridesharing Insurance

Ridesharing services have transformed the way many individuals think about vehicle use and insurance. For those who engage in ridesharing, it is crucial to understand that traditional personal auto policies may not provide coverage during the time the vehicle is being used to transport passengers for a fee. As a result, many auto insurance companies have developed specific ridesharing insurance policies to fill this gap.

These specialized policies often come with endorsements that extend coverage for drivers while they are logged into ridesharing apps. This is particularly important as it ensures that drivers are protected against liabilities that might arise during their time on the road for business purposes. Rideshare drivers should consult with their insurance providers to confirm the adequacy of their coverage and to explore any potential endorsements that can enhance their protection.

When to Transition to a Commercial Auto Policy

As businesses grow, their vehicle use often becomes more complex, necessitating a transition from a personal auto policy to a commercial auto policy. This is particularly true when employees are involved in operations that require transporting goods or clients, or if the business uses multiple vehicles. A commercial auto policy is designed to cover a wider range of scenarios and higher liability limits, which is essential for business operations.

Additionally, if the business requires vehicles that exceed the weight limits imposed by personal auto policies, such as trucks or vans, a commercial auto policy will be necessary to ensure compliance with insurance regulations. Business owners should regularly review their vehicle usage and consult with an insurance professional to determine the appropriate time to transition to a commercial policy, thereby ensuring they have the necessary coverage to protect their assets.

Assessing Coverage Limitations of Personal Auto Policies

While personal auto policies can provide adequate coverage for many small business owners, it is essential to understand their limitations. For example, these policies may not cover certain high-risk activities such as transporting hazardous materials, or they might impose restrictions on the type of vehicles that can be insured. This can leave business owners vulnerable in situations where their activities exceed the scope of the personal auto policy.

Business owners should conduct a thorough assessment of their vehicle use and the associated risks to determine whether their personal auto policy is sufficient or if they need to explore commercial auto insurance options. Engaging with a knowledgeable insurance agent can provide valuable insights into the nuances of coverage limitations and help ensure that business owners have the comprehensive protection required for their specific circumstances.

The Role of Independent Agents in Finding the Right Coverage

Navigating the complexities of auto insurance can be overwhelming, especially for business owners who need to balance personal and commercial coverage requirements. This is where independent insurance agents play a crucial role. They can provide tailored advice based on individual business needs and help identify the most suitable insurance products, whether it be a personal auto policy or a commercial auto policy.

Independent agents have access to a wide range of insurance providers and can compare policies, coverage options, and premiums to ensure that clients receive the best value for their insurance investment. By leveraging their expertise, business owners can make informed decisions about their vehicle insurance, ensuring they have adequate protection that aligns with their operational needs.

Frequently Asked Questions

What types of businesses can be covered under a personal auto policy?

A personal auto policy can typically cover businesses such as real estate agents, consultants, lawyers, sales representatives, and doctors. These professions usually involve the use of personal vehicles for business purposes, provided they are not primarily used for transporting goods.

Who is allowed to operate a vehicle under a personal auto policy?

Under a personal auto policy, you and family members in your household can operate the vehicle as long as you are not using it for delivery or transporting goods. If employees regularly use the vehicle, it may require a commercial auto policy instead.

How does the use of a vehicle affect my personal auto policy coverage?

If you use your vehicle for deliveries or transportation for hire, such as pizza delivery or taxi services, a personal auto policy may not suffice. In these cases, a commercial auto policy is typically necessary. However, ridesharing activities with companies like Uber or Lyft may be covered by endorsements on your personal auto policy.

What should I do if my company provides a vehicle for my use?

If your employer provides a vehicle, it generally falls under their commercial auto policy. However, it is advisable to also have personal auto policy coverage, which can be secured through an endorsement to protect yourself in personal use situations.

What benefits does a personal auto policy offer for business owners?

A personal auto policy provides essential auto insurance coverage for personal vehicles used in business. It typically includes features like 24/7 roadside assistance and various discounts to help save on insurance costs, making it a valuable option for business owners who use their personal vehicles.

Can I use my personal auto policy for ridesharing activities?

Yes, many personal auto policies offer endorsements specifically for ridesharing activities. If you drive for companies like Uber or Lyft, check with your insurance provider to ensure you have the appropriate coverage for your ridesharing activities.

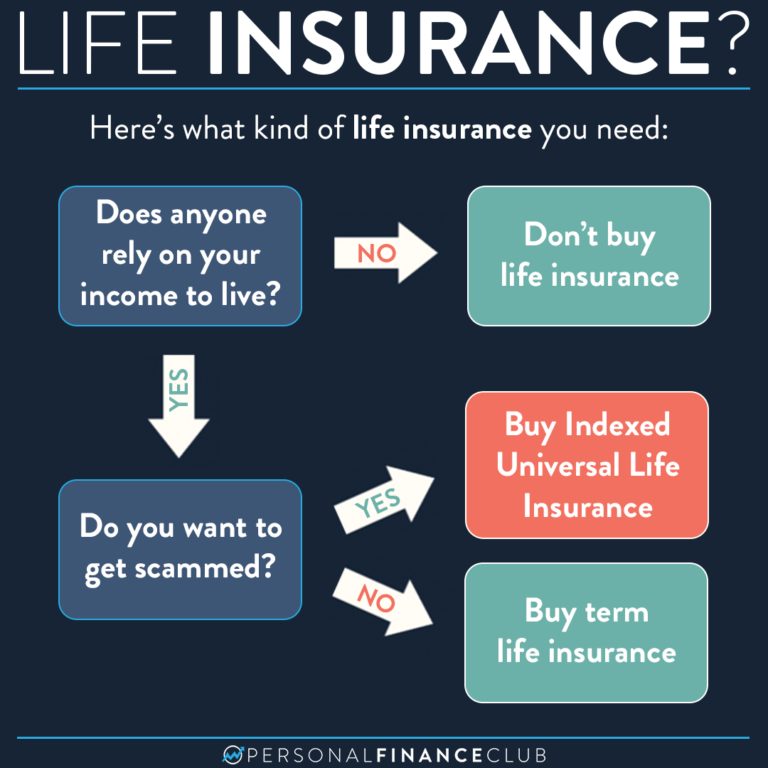

What is the difference between a personal auto policy and a commercial auto policy?

A personal auto policy is designed for personal use and small business applications, while a commercial auto policy is tailored for businesses that use vehicles primarily for commercial purposes, including transporting goods or passengers for hire.

Are there limitations to using my personal auto policy for business purposes?

Yes, limitations exist, especially regarding the type of vehicle and its use. Vehicles over 10,000 pounds gross weight and those used for deliveries or transporting goods typically require a commercial auto policy.

| Key Point | Details |

|---|---|

| Acceptable Businesses | Real estate agents, consultants, lawyers, sales representatives, doctors. |

| Vehicle Operators | Sole operators or family members; not for transporting goods. |

| Vehicle Weight Limitations | Vehicles over 10,000 pounds do not qualify for personal auto policy. |

| Use of Vehicle | Delivery services and transportation for hire require commercial insurance. |

| Company Vehicles | Coverage usually under company’s commercial policy; personal policy add-on recommended. |

| Central Insurance Offerings | Variety of auto insurance coverages, including 24/7 roadside assistance. |

Summary

A personal auto policy is crucial for individuals who use their vehicles for both personal and business purposes. It provides essential coverage for acceptable business types, such as real estate agents and consultants, while also outlining restrictions for vehicle operators and weight limitations. Additionally, understanding when to transition to a commercial policy is vital, especially for businesses involved in delivery or transportation services. Ensuring adequate coverage under a personal auto policy can protect you from unforeseen liabilities, making it a wise choice for many small business owners.