Update Insurance Policy: Essential Tips for Small Businesses

Updating your insurance policy is a critical step in safeguarding your small business against unforeseen challenges and risks. Often, the daily grind of running your operations can overshadow the importance of an insurance needs assessment, leaving your coverage outdated. Have you recently reviewed your insurance policy? Regular insurance policy reviews can help ensure that your insurance coverage updates align with the evolving landscape of your business. Whether it’s due to expansion, new services, or changing market conditions, maintaining adequate business insurance is essential to protect your investments.

Are you considering adjustments to your coverage? Keeping your insurance in sync with your business operations is vital for risk management. When you introduce new offerings, expand your team, or relocate, it’s crucial to evaluate how these changes impact your insurance needs. Regularly revisiting your insurance strategy ensures that you remain shielded from potential liabilities that may arise. Engaging with an insurance expert can provide valuable insights into how to effectively manage your insurance portfolio as your business grows.

Understanding the Importance of Business Insurance

Business insurance is a crucial component for any small business, serving as a financial safety net against unexpected events. It protects your assets, employees, and overall operational continuity. Whether you run a brick-and-mortar store or an online service, having the right business insurance can mean the difference between recovery and closure following a mishap. An effective insurance policy should cater to specific business needs, ensuring that all potential risks are accounted for, thus allowing business owners to operate with peace of mind.

Moreover, the landscape of business insurance is constantly evolving, with new risks emerging every day. As businesses grow and change, so do their insurance needs. Regularly reviewing your insurance policy ensures that you have adequate coverage that reflects your current operations. It’s essential to assess your insurance needs and make adjustments as necessary, especially when significant changes occur, such as introducing new products or moving to a larger space.

When to Conduct an Insurance Needs Assessment

Carrying out an insurance needs assessment is a vital step in ensuring your business is adequately protected. This assessment involves evaluating your current coverage against your business activities and potential risks. If you’ve recently expanded your offerings or hired new employees, it’s time to reassess your policy to ensure it covers all aspects of your business. Failing to do so could leave you vulnerable to significant losses that your current policy doesn’t cover.

In addition, consider personal circumstances that might influence your insurance needs, such as changes in the leadership of your company or modifications in your operational processes. Regular assessments allow you to proactively identify gaps in coverage and address them before they become problematic. This proactive approach not only safeguards your business but also strengthens your relationship with your insurance provider.

The Necessity of Regular Insurance Policy Reviews

Regular insurance policy reviews are essential for small business owners to keep their coverage relevant and effective. As your business evolves, so should your insurance coverage. This means periodically engaging with your insurance provider to discuss any changes in your business operations, such as expansions or shifts in the market. A thorough policy review can reveal potential inadequacies in your current coverage, ensuring that your business is protected against unforeseen circumstances.

Moreover, the insurance landscape itself can change due to new regulations or emerging risks. By staying informed and conducting regular reviews, you can adjust your policy to incorporate necessary updates or new types of coverage that may have become available. This not only helps to mitigate risks but also reflects a commitment to maintaining a robust risk management strategy for your business.

Recognizing the Signs to Update Your Insurance Policy

Understanding when to update your insurance policy is critical for effective risk management. Key indicators include significant business changes such as hiring new staff, expanding to new locations, or introducing new products. Each of these changes can influence the level of risk associated with your business. For instance, hiring more employees increases liability exposure, while expanding product lines may require additional coverage for new types of risks.

Additionally, external factors such as changes in the neighborhood or alterations in local regulations can also necessitate a policy update. Staying attuned to these signals ensures that your business remains protected and compliant with current laws. If you notice any changes in your business landscape, it’s wise to reach out to your insurance provider and discuss the potential need for updates.

The Role of Your Insurance Provider in Coverage Updates

Your insurance provider plays a pivotal role in managing your coverage updates. They can offer insights into your current policy and suggest necessary adjustments based on recent changes in your business operations. Establishing a strong relationship with your insurance agent or broker allows you to communicate your evolving needs effectively and receive tailored recommendations for your coverage.

Furthermore, your insurance provider can help you navigate the complexities of your policy and clarify any adjustments that may be needed. Regular communication ensures that you are not only compliant with regulations but also adequately protected against risks that could impact your business’s sustainability.

Evaluating Coverage for New Products and Services

When you introduce new products or services, it’s essential to evaluate how these changes impact your insurance coverage. New offerings may come with unique risks that your existing policy does not cover. Therefore, a thorough analysis of potential liabilities associated with these products is necessary to ensure that your insurance adequately protects your business from any unforeseen claims.

In addition to product liability, consider the impact of service expansions on your operational risks. For instance, if you launch an online service, you may need additional coverage for cyber liability. Engaging with your insurance provider to discuss these changes helps to mitigate risks and ensures that your policy aligns with your current business model.

How Business Changes Impact Insurance Coverage

Business changes, whether large or small, can significantly impact your insurance coverage needs. For example, relocating to a new facility may expose your business to different risks, such as theft or property damage. Similarly, adding new equipment or technology can introduce additional liability, which must be factored into your insurance policy. Thus, it’s crucial to assess how these changes could affect your coverage and to communicate these factors with your insurance provider.

Moreover, the introduction of new agreements or contracts with suppliers can also alter your risk profile. These changes could necessitate an update to your liability coverage to account for new responsibilities or risks associated with these partnerships. Regularly reviewing your insurance policy in light of these changes ensures that your coverage adapts to your evolving business landscape.

Navigating Insurance Coverage for Employees

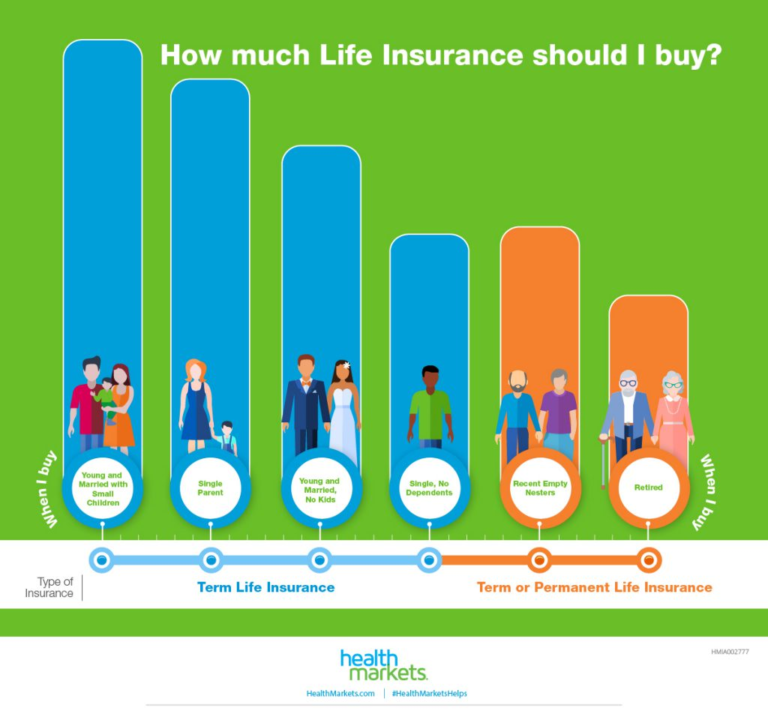

When your business hires new employees or undergoes changes in personnel, it’s essential to evaluate your insurance coverage accordingly. Employee turnover and the addition of new roles can influence your liability exposure, making it necessary to reassess your worker’s compensation and liability insurance. Ensuring that your coverage reflects your current workforce helps protect both your employees and your business from potential claims.

Additionally, as your team grows, you may need to consider health insurance options and other employee benefits that align with your business’s evolving needs. Engaging with your insurance provider can help you navigate these changes, ensuring that your coverage meets legal requirements and supports your workforce effectively.

The Benefits of Consulting with Insurance Experts

Consulting with insurance experts can provide invaluable guidance as you navigate the complexities of your coverage needs. These professionals can help you conduct thorough insurance needs assessments and policy reviews, ensuring that you are fully aware of any gaps in your coverage. Their expertise can aid in making informed decisions about necessary updates, particularly as your business grows and evolves.

Moreover, insurance experts can keep you informed of emerging risks and changes in the market that might affect your coverage. By collaborating with an insurance broker, you can develop a comprehensive risk management strategy that protects your business against potential liabilities, ensuring you are always prepared for the unexpected.

Frequently Asked Questions

When should I update my insurance policy for my small business?

You should update your insurance policy whenever there are significant changes in your business, such as hiring new employees, relocating, introducing new products or services, or upgrading technology. Regularly reviewing your insurance policy ensures that your coverage aligns with your current business needs and risks.

How can I assess my insurance coverage updates?

To assess your insurance coverage updates, conduct a thorough insurance needs assessment. Review any changes in your operations, property, and employee count. Also, consult with your insurance provider to identify any gaps in your coverage and make necessary updates to your policy.

What are the benefits of an insurance policy review for small businesses?

An insurance policy review helps ensure your coverage meets your current business activities and risks. It can identify outdated provisions, potential gaps in coverage, and opportunities for better rates or terms, ultimately protecting your business and potentially saving costs.

How does a change in location affect my insurance policy?

A change in location can significantly impact your insurance policy, as different areas may present unique risks and liabilities. It’s essential to notify your insurance provider to adjust your coverage and ensure that your new premises are adequately protected.

What should I consider when updating my business insurance policy?

When updating your business insurance policy, consider changes in your employee count, services offered, property or equipment values, and any new contracts or agreements. Keeping your insurance coverage updated with these changes helps mitigate risks associated with your evolving business.

Can I update my insurance policy mid-term?

Yes, you can update your insurance policy mid-term. It’s advisable to contact your insurance provider whenever significant changes occur in your business to ensure that your coverage reflects your current needs and offers adequate protection.

How often should I review my small business insurance coverage?

It is recommended to review your small business insurance coverage at least once a year or whenever a major change occurs in your business. Regular reviews help ensure that your insurance coverage remains relevant and sufficient for your current business operations.

What role does an insurance broker play in updating my policy?

An insurance broker plays a crucial role in updating your policy by providing expertise and guidance. They can help assess your insurance needs, recommend necessary updates, and ensure that your policy adequately covers the risks associated with your evolving business.

What types of changes might require an insurance policy update?

Changes that might require an insurance policy update include hiring new staff, launching new products, relocating, entering new contracts, adding new locations, or upgrading technology. Each of these changes can affect your risk profile and the coverage needed.

How can I ensure my insurance policy is effectively managing my business risks?

To ensure your insurance policy effectively manages your business risks, regularly conduct an insurance needs assessment and maintain open communication with your insurance provider. This allows you to update your policy as needed and adapt to changes in your business environment.

| Key Point | Details |

|---|---|

| Review Insurance Regularly | Daily operations can distract from the need to review your insurance policy. |

| Timing for Updates | Update your policy when you experience changes in your business, even minor ones. |

| Maintain Relationships with Providers | Stay in contact with your insurance provider to discuss changes in your business. |

| Changes that Require Updates | Hiring, relocating, new products/services, neighborhood changes, new contracts, vehicle purchases, security upgrades, ownership changes. |

| Consult Experts | Work with an insurance representative to ensure adequate coverage. |

| Focus on Business Growth | A good insurance policy allows you to concentrate on business growth without worrying about risks. |

Summary

Updating your insurance policy is essential to ensure your business is adequately protected as it evolves. Regularly reviewing your coverage allows you to adapt to changes such as hiring new employees, relocating, or introducing new products. By prioritizing the update of your insurance policy, you can safeguard your business against potential risks and losses, enabling you to focus on growth and success.