Disability Insurance: Scott Rider’s Life-Changing Story

Disability insurance is a vital financial safety net that can profoundly impact your life, as exemplified by Scott Rider’s inspiring journey. This type of insurance provides essential income replacement when illness or injury prevents you from working, ensuring financial stability with disability insurance. With a diagnosis like Parkinson’s disease, Scott found himself navigating significant changes, but the benefits of disability insurance allowed him to maintain his quality of life and support his family. Many individuals may underestimate the importance of disability insurance, yet for Scott, it has been a lifeline that empowers him to continue living fully despite his challenges. His story illustrates how disability insurance coverage not only secures financial peace of mind but also fosters resilience in the face of adversity.

When we talk about income protection in the event of an unforeseen health crisis, the terms ‘income replacement insurance’ and ‘long-term disability coverage’ often come to mind. These financial tools are essential for anyone who relies on their salary to sustain their lifestyle, especially in cases of severe health issues like those faced by Scott Rider. By offering a steady income stream during times of incapacity, these policies play a crucial role in maintaining one’s financial integrity. Scott’s experience highlights how having adequate coverage can make life manageable, allowing families to focus on what truly matters without the added stress of financial burdens. Understanding the nuances of these insurance options is key to safeguarding your future.

The Life-Changing Benefits of Disability Insurance

Disability insurance offers a safety net for individuals who face unexpected health challenges that prevent them from working. For many, like Scott Rider, this type of coverage becomes a lifeline, ensuring financial stability in the face of adversities such as serious illnesses or injuries. The primary benefit of disability insurance lies in its ability to replace a portion of lost income, allowing policyholders to focus on recovery without the constant worry of financial strain. This means that even if an individual cannot return to their previous job, they can still maintain their standard of living and meet financial obligations.

Moreover, the benefits of disability insurance extend beyond mere financial support. It provides peace of mind, knowing that there is a backup plan in place should life take an unexpected turn. For Scott, having this insurance meant he could still support his family while dealing with the realities of Parkinson’s disease. His story highlights how essential it is to consider disability insurance, especially for those who rely heavily on their income to sustain their lifestyles.

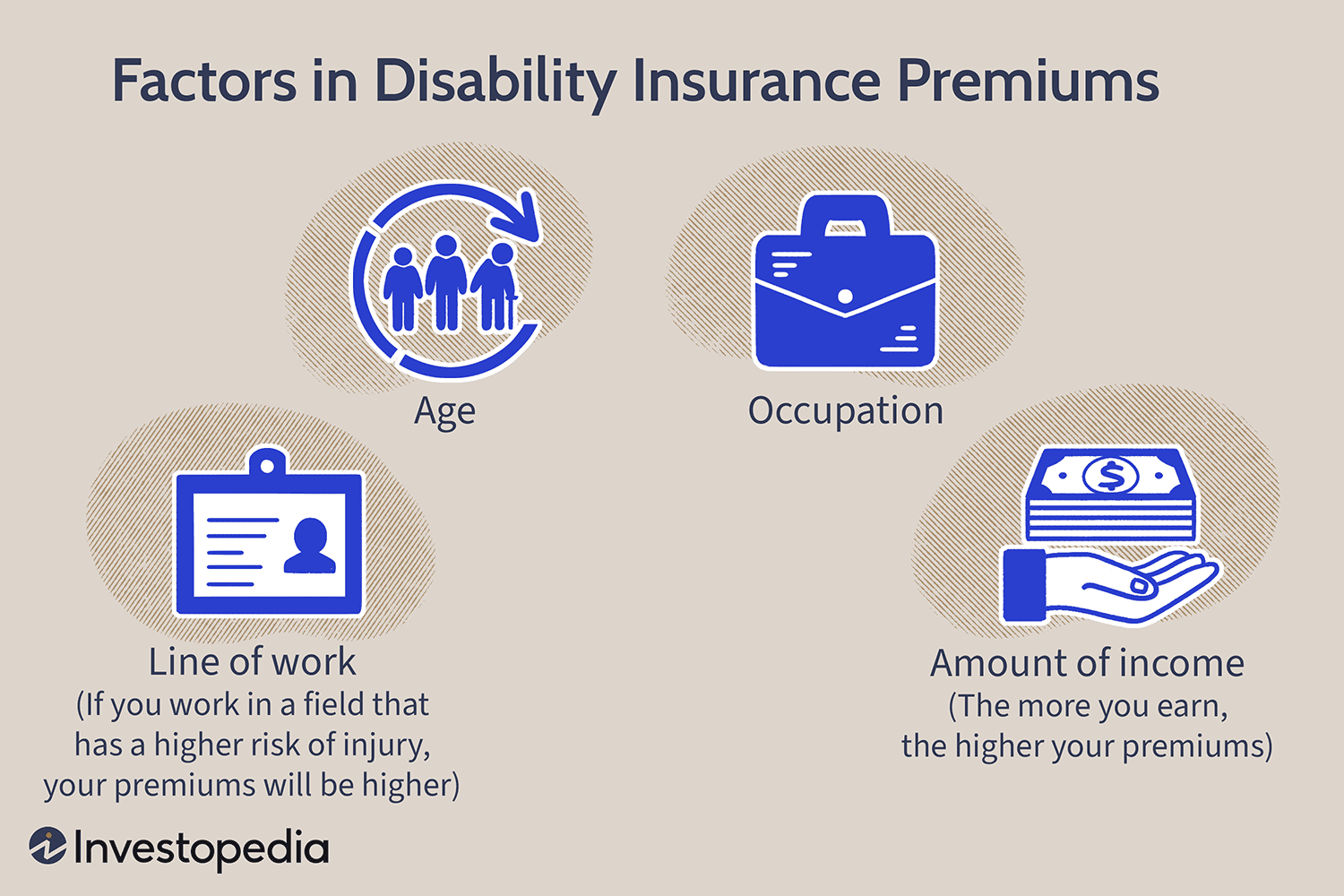

Understanding Disability Insurance Coverage

Disability insurance coverage can vary significantly between policies, making it essential for individuals to understand the specifics of what they are signing up for. Typically, there are two main types of disability insurance: short-term and long-term. Short-term disability insurance provides coverage for a limited period, usually a few months, while long-term disability insurance offers support for extended durations, potentially until retirement age. Scott Rider’s experience illustrates the importance of securing long-term coverage, as his condition means he will not be able to return to work.

In addition to the duration of coverage, individuals should consider other factors such as the percentage of income replaced, waiting periods, and any exclusions that may apply. Scott emphasizes that having both employer-provided and individual disability insurance significantly bolstered his financial security. This dual coverage allowed him to navigate the challenges of his illness without jeopardizing his family’s financial future, showcasing the importance of comprehensive disability insurance coverage.

The Importance of Disability Insurance in Today’s World

In today’s unpredictable world, the importance of disability insurance cannot be overstated. Many individuals underestimate the likelihood of becoming disabled at some point in their lives, which can lead to devastating financial consequences. Scott Rider’s journey serves as a powerful reminder of how quickly circumstances can change. With the right insurance, individuals can protect their most valuable asset: their ability to earn an income. This insurance not only shields them from potential financial ruin but also allows them to maintain a quality of life during difficult times.

Furthermore, the importance of disability insurance extends to families, as it helps to ensure that loved ones are not left in financial distress if the primary earner is unable to work. As Scott highlights, his disability insurance payments have allowed his wife to remain at home and continue supporting their family without the added stress of immediate financial burdens. The security that comes from knowing there is a financial plan in place can significantly alleviate anxiety and foster resilience during challenging times.

Financial Stability with Disability Insurance

Achieving financial stability in the face of adversity is a primary goal for many individuals, and disability insurance is a key component in reaching that goal. Scott Rider’s story exemplifies how this insurance can provide a reliable income stream even when circumstances change drastically. By having disability insurance in place, individuals can ensure that they have the means to cover essential expenses, such as mortgage payments, medical bills, and everyday living costs, thus preserving their financial health.

Moreover, financial stability gained through disability insurance allows families to focus on what truly matters: healing and spending time together. For Scott, the peace of mind that comes from knowing he has a safety net has made a world of difference in managing his Parkinson’s disease. His ability to stay in his dream home and support his daughter’s wedding without dipping into retirement savings underscores the significant role that disability insurance plays in safeguarding financial futures.

Scott Rider’s Inspiring Journey with Disability Insurance

Scott Rider’s journey is a testament to the transformative power of disability insurance. Initially known for his athletic prowess and active lifestyle, Scott faced an abrupt change when diagnosed with Parkinson’s disease. However, thanks to his foresight in obtaining disability insurance, he was able to navigate this life-altering event without succumbing to financial despair. His story is not just about loss; it is about resilience and the ability to adapt to new realities while maintaining a sense of normalcy and hope.

Scott’s advocacy for disability insurance is rooted in his personal experiences. He believes that everyone should consider this type of coverage, regardless of their current health status. His journey highlights the critical need for individuals to prepare for the unexpected, as life can change in an instant. Through his story, Scott inspires others to take action and secure their financial future by investing in disability insurance that can provide stability during uncertain times.

How to Choose the Right Disability Insurance Policy

Choosing the right disability insurance policy is a crucial step in safeguarding your financial future. With various options available, it’s essential to assess your individual needs, income level, and risk factors. Scott Rider recommends consulting with an insurance professional who can guide you through the specifics of different policies, helping you to identify what level of coverage will be appropriate for your situation. A knowledgeable agent can clarify the differences between short-term and long-term policies, ensuring you make an informed decision.

Additionally, understanding the terms of the policy is vital. It’s important to know the waiting periods, benefit lengths, and any exclusions that might apply. Scott emphasizes the importance of having both employer-sponsored and individual policies; this combination can provide a more robust safety net. By carefully evaluating your options and seeking expert advice, you can select a disability insurance policy that will best meet your financial needs and provide peace of mind.

The Role of Employers in Providing Disability Insurance

Employers play a significant role in facilitating access to disability insurance for their employees. Many companies offer group disability insurance as part of their benefits package, which can be a valuable resource for workers. Scott Rider benefited from his employer’s disability insurance, which laid the foundation for his financial stability after his diagnosis. This employer-provided coverage can be a crucial first step in securing financial protection against unforeseen circumstances.

However, it’s essential for employees to understand that employer-sponsored plans may not cover all potential needs. Scott’s experience shows that having an individual disability policy in addition to employer coverage can provide added security. Employees should take the initiative to review their benefits and consult with an insurance advisor to ensure they have adequate protection tailored to their unique circumstances.

Raising Awareness about Disability Insurance

Raising awareness about disability insurance is critical in helping individuals understand the importance of protecting their income. Many people are unaware of the risks associated with being unable to work due to illness or injury, and thus overlook disability insurance. Scott Rider’s advocacy highlights the need for education on this topic. By sharing his personal story, he shines a light on how disability insurance can make a profound difference in one’s life, emphasizing that it’s not just a financial product but a vital part of a comprehensive financial plan.

Community outreach and educational initiatives can help demystify disability insurance, making it more accessible to those who need it most. Workshops, informational sessions, and online resources can be powerful tools in promoting understanding and encouraging individuals to take proactive steps towards securing their financial futures. Scott’s story serves as a compelling call to action for others to consider their own needs and the potential benefits of disability insurance.

The Future of Disability Insurance in a Changing World

The future of disability insurance is evolving in response to the changing landscape of work and health. As the workforce adapts to new challenges, including remote work and the rising prevalence of chronic illnesses, the need for robust disability insurance options becomes increasingly important. Scott Rider’s situation illustrates how essential it is for individuals to remain informed about their coverage options and advocate for policies that meet their needs, especially in uncertain times.

Insurance companies are also adapting, offering more tailored solutions that reflect the diverse needs of today’s workforce. Innovations in policy offerings can help ensure that individuals have access to the support they require, regardless of their circumstances. As awareness grows and more individuals like Scott share their experiences, the hope is that disability insurance will become a standard consideration for everyone, ensuring that financial protection is available to those who need it most.

Frequently Asked Questions

What are the benefits of disability insurance?

Disability insurance provides financial support if you become unable to work due to illness or injury. It replaces a portion of your income, helping maintain your financial stability and quality of life during challenging times. As illustrated by Scott Rider’s experience, disability insurance ensures that necessary expenses are covered, allowing individuals to focus on recovery without the stress of financial burdens.

How does disability insurance coverage work?

Disability insurance coverage typically offers income replacement for a specified period if you are unable to work due to a disability. It pays a percentage of your pre-disability earnings, helping to cover living expenses, medical bills, and other costs. For example, Scott Rider’s disability insurance provides ongoing payments that have allowed him to maintain his family’s lifestyle despite his Parkinson’s disease.

Why is the importance of disability insurance often overlooked?

Many people overlook the importance of disability insurance because they believe they will never become disabled or underestimate the financial impact of losing their income. However, as Scott Rider’s story shows, having disability insurance is crucial for protecting your ability to earn a living. It provides peace of mind and financial security when life takes an unexpected turn.

How does disability insurance ensure financial stability?

Disability insurance ensures financial stability by providing a consistent income stream when you are unable to work due to an illness or injury. This coverage allows individuals and families to meet their obligations, such as mortgage payments and daily living expenses. Scott Rider highlights how his disability insurance has enabled him to stay in his dream home and secure his family’s financial future, emphasizing its importance.

Can you share the Scott Rider story regarding disability insurance?

Scott Rider’s story illustrates the profound impact of disability insurance on an individual’s life. Diagnosed with Parkinson’s disease, Scott faced significant changes but remained financially stable due to his disability insurance. He advocates for this coverage, stating it allowed him to focus on recovery without financial stress, maintain his family’s lifestyle, and ensure his wife and daughter’s needs were met.

| Key Points | Details |

|---|---|

| Scott Rider’s Background | An optimistic individual, enthusiastic biker, community participant, and family man diagnosed with Parkinson’s disease. |

| Importance of Disability Insurance | Provides financial stability by replacing a portion of income if unable to work due to illness or injury. |

| Impact on Scott’s Life | Enabled Scott to maintain his lifestyle and support his family despite his illness. |

| Financial Benefits | Allowed Scott to avoid tapping into retirement savings and cover living expenses. |

| Advice for Others | Consult with an insurance professional and check for existing coverage through your employer. |

Summary

Disability insurance is crucial for anyone who depends on their income, especially in the face of unexpected health challenges. Scott Rider’s experience highlights the significance of having disability insurance to ensure financial stability. Despite his diagnosis of Parkinson’s disease, he has been able to maintain his quality of life and support his family thanks to the financial assistance provided by his disability insurance. This coverage not only protects his income but also helps him avoid financial strain, allowing him to focus on his health and family. Exploring disability insurance options is essential for safeguarding your future and preserving your lifestyle in times of need.