Life Insurance: Kelly Rowland’s Message of Love and Protection

Life insurance is not just a financial product; it is a profound commitment to safeguarding the future of your loved ones. This September, as we observe Life Insurance Awareness Month, it’s crucial to delve into the benefits of life insurance and how it serves as a protective shield for families. With every policy, you are not only ensuring financial stability for your dependents but also communicating a message of love and security. Kelly Rowland, a celebrated artist and devoted mother, emphasizes this sentiment, illustrating how life insurance provides peace of mind amid life’s uncertainties. By understanding life insurance tips and the importance of having coverage, families can embark on a journey of financial preparedness and emotional assurance.

When we talk about life coverage, we refer to a safety net designed to protect your family from unforeseen circumstances. This essential financial tool offers assurance that your loved ones will be taken care of in your absence, making it invaluable for families. As we approach Life Insurance Awareness Month, it’s important to highlight the various advantages associated with securing life coverage, including peace of mind and financial security. Celebrities like Kelly Rowland serve as powerful advocates, using their platforms to educate others on why acquiring such protection is necessary. By shifting the narrative around life coverage, we can encourage more conversations and help families realize the importance of planning for the future.

Understanding Life Insurance and Its Importance

Life insurance is a crucial financial tool that provides peace of mind and security for families. It ensures that your loved ones are financially protected in the event of untimely death. For many, like Kelly Rowland, the realization of this necessity often comes from personal experiences or conversations with friends. Life insurance is not just a policy; it is a commitment to protect those you care about most. By investing in a life insurance policy, you are essentially saying, ‘I love you and I want to ensure your future is secure, regardless of what happens.’

Moreover, life insurance is particularly beneficial for families. It can cover daily living expenses, mortgage payments, educational costs, and other financial obligations that may arise when a primary earner is no longer there. This financial safety net allows families to grieve without the added stress of financial burdens, making it an essential consideration for anyone with dependents. Understanding the benefits of life insurance can lead to informed decisions that safeguard your family’s future.

Life Insurance Awareness Month: A Time to Reflect

September is recognized as Life Insurance Awareness Month, a time dedicated to educating individuals about the importance of life insurance. This initiative encourages conversations around financial security and the necessity of having adequate coverage. Celebrities like Kelly Rowland use their platforms to spread awareness, emphasizing that having life insurance is an act of love towards family. It’s not just a financial product; it’s a way of ensuring your loved ones are taken care of during challenging times.

During this month, individuals are encouraged to take action by assessing their life insurance needs. Many may not realize how affordable and accessible life insurance can be. Resources such as Life Insurance Needs Calculators can help families determine the right amount of coverage needed based on their specific circumstances. Life Insurance Awareness Month serves as a reminder that planning for the future is essential and that having these discussions can make a significant difference in the lives of your loved ones.

Tips for Choosing the Right Life Insurance Policy

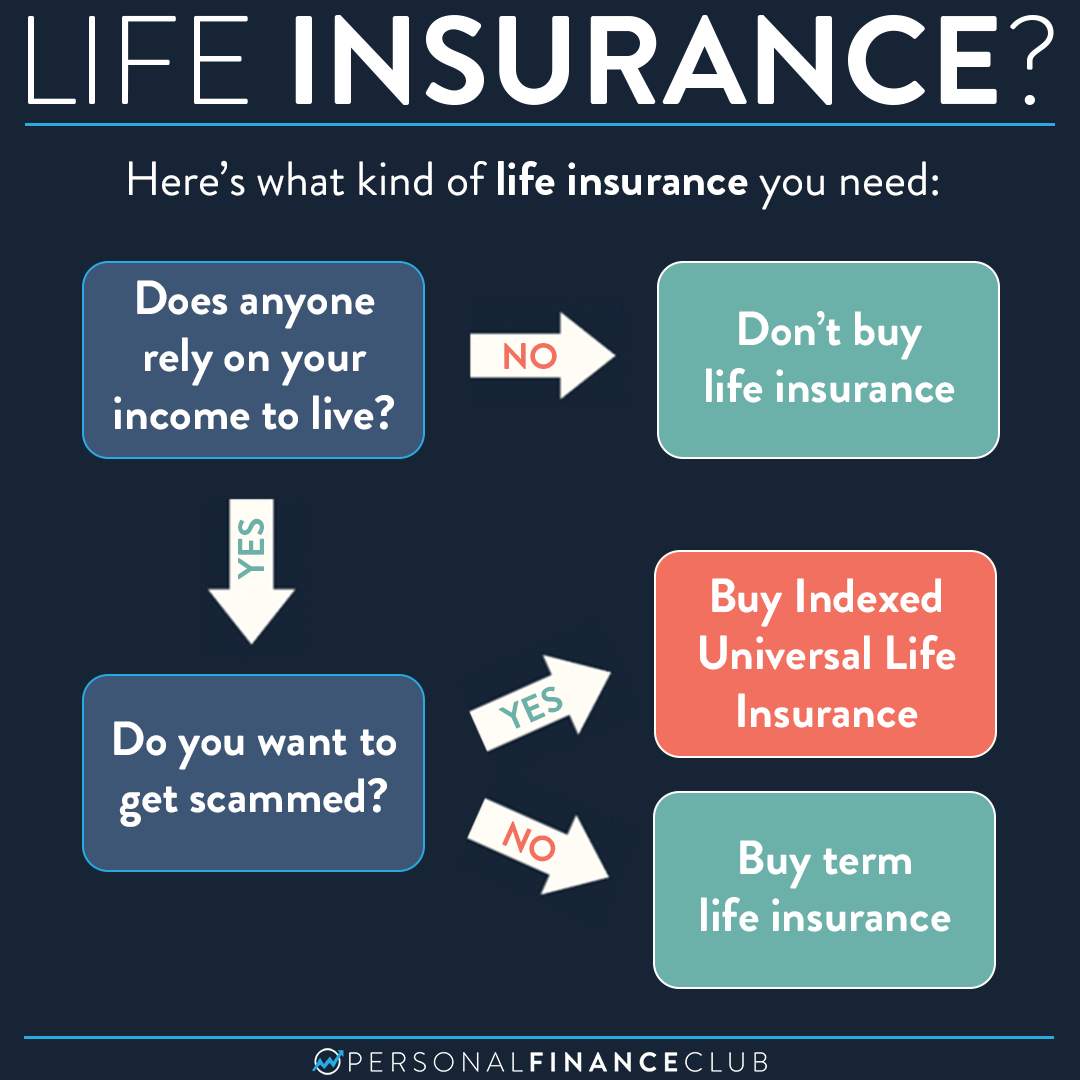

Choosing the right life insurance policy can be daunting, but there are several tips to consider that can simplify the process. First, assess your family’s financial needs. Consider factors like your current debts, future expenses like college tuition for children, and daily living costs. This will help you determine how much coverage is necessary to ensure your family is secure. Additionally, it’s important to understand the different types of life insurance available—term life, whole life, and universal life insurance each have unique benefits and considerations.

Another crucial tip is to shop around and compare quotes from different providers. Not all life insurance companies offer the same rates or coverage options, so it’s wise to explore various policies. Also, consider consulting with a life insurance advisor who can guide you through the complexities of the policies, ensuring you choose a plan that aligns with your financial goals and family needs. Taking these steps can lead to a well-informed decision that provides lasting peace of mind.

The Emotional Benefits of Life Insurance

Life insurance is often viewed purely through a financial lens; however, the emotional benefits are just as significant. For families, knowing that they have a safety net can alleviate anxiety and stress about the future. As Kelly Rowland pointed out, having life insurance brings a sense of freedom—a burden lifted from the shoulders of those who take this important step. It’s a way to communicate love and responsibility, ensuring that loved ones are protected even in the worst circumstances.

Furthermore, discussing life insurance can open the door to deeper conversations about family values and priorities. Engaging in these discussions encourages families to think about their long-term goals and the legacy they want to leave behind. By addressing the topic of life insurance, families can create a plan that reflects their values, ultimately strengthening their bonds and providing reassurance that they are prepared for life’s uncertainties.

Life Insurance for Families: A Necessary Investment

When considering life insurance, families must recognize it as a necessary investment for their future. With so many responsibilities, from mortgages to children’s education, having an adequate life insurance policy can provide financial stability. It ensures that, in the event of an unforeseen circumstance, families can maintain their standard of living without the added stress of financial strain. Life insurance is about safeguarding the dreams and aspirations of the family unit, offering them the opportunity to thrive even in difficult times.

Additionally, having life insurance can encourage families to engage in proactive financial planning. This foresight can lead to better financial habits, as families become more aware of their spending and saving patterns when they prioritize life insurance. It’s not just about protecting against loss; it’s also about fostering a culture of financial responsibility within the family, ensuring that all members are on the same page regarding their financial future.

Breaking the Stigma Around Life Insurance

Despite its importance, there is often a stigma associated with discussing life insurance. Many people avoid the topic for fear of confronting mortality or because they feel it’s a morbid subject. However, as advocates like Kelly Rowland highlight, breaking this stigma is essential for ensuring families are adequately protected. Open discussions about life insurance can empower individuals to take charge of their financial destinies, transforming a potentially uncomfortable topic into a proactive conversation about security and love.

By reframing the narrative around life insurance, we can emphasize its role as a financial safety net rather than a reminder of loss. This shift in perspective encourages more people to consider life insurance as a tool for empowerment and peace of mind. Education and awareness initiatives, particularly during Life Insurance Awareness Month, can help demystify life insurance, making it a more approachable and understood aspect of financial planning.

Resources for Life Insurance Education

In the digital age, there are abundant resources available for individuals seeking to educate themselves about life insurance. Websites like Life Happens provide unbiased information on the basics of life insurance, helping individuals navigate the various options available. From understanding the different types of policies to calculating your insurance needs, these resources are invaluable for making informed decisions. Additionally, many organizations offer webinars and workshops that can further enhance understanding of life insurance and its benefits.

Furthermore, engaging with a life insurance agent or advisor can provide personalized insights based on your unique circumstances. These professionals can offer tailored advice, helping you to select the best policy that fits your family’s needs and financial goals. By utilizing these resources, individuals can feel more confident in their understanding of life insurance, leading to better choices that protect their loved ones.

The Future of Life Insurance: Trends and Innovations

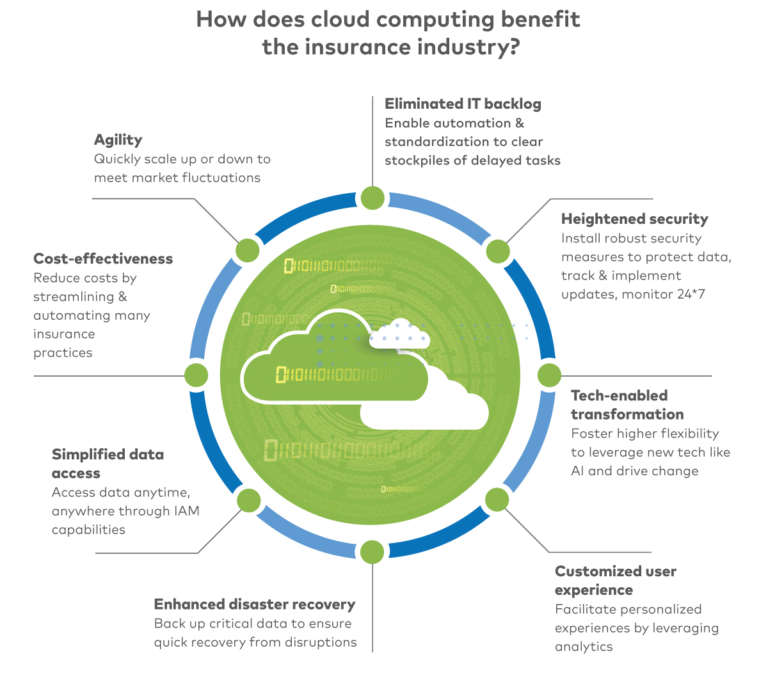

The life insurance industry is continually evolving, with new trends and innovations shaping how policies are developed and marketed. One significant trend is the increased use of technology in the application process. Digital platforms now allow consumers to compare quotes, access information, and even apply for coverage online, making the process more accessible than ever. This technological advancement is particularly appealing to younger generations who prefer online solutions.

Additionally, there is a growing emphasis on personalized insurance products that cater to individual needs. Insurers are leveraging data analytics to create tailored policies that account for lifestyle choices and health factors, ensuring that coverage is more relevant and affordable. As the industry adapts to changing consumer preferences, it will likely continue to innovate, making life insurance more appealing and easier to understand for families everywhere.

How to Start the Conversation About Life Insurance

Starting the conversation about life insurance can be intimidating, but it’s a necessary discussion that can lead to greater family security. One effective way to initiate the topic is by sharing personal stories or experiences, much like how Kelly Rowland learned from her friend’s loss. Bringing real-life examples into the conversation can help frame the discussion in a relatable context, making it easier for loved ones to understand the importance of life insurance.

Another strategy is to approach the topic during significant family events, such as birthdays or anniversaries, when discussions about the future are more natural. You can express your desire to ensure that your family is protected and secure, reinforcing the notion that life insurance is an expression of love and responsibility. By creating an open dialogue around life insurance, families can work together to make informed decisions that prioritize their collective future.

Frequently Asked Questions

What is Life Insurance Awareness Month and why is it important?

Life Insurance Awareness Month (LIAM) occurs every September and serves to educate the public about the benefits of life insurance. It aims to highlight the importance of life insurance in protecting families financially in the event of an unexpected loss. This month encourages individuals to consider their life insurance needs and the peace of mind it brings.

What are the benefits of life insurance for families?

The benefits of life insurance for families are substantial. Life insurance provides financial security, covering debts, daily living expenses, and future needs such as education costs for children. It ensures that loved ones are taken care of during difficult times, allowing families to maintain their standard of living despite the loss of an income earner.

What are some essential life insurance tips for new buyers?

Some essential life insurance tips for new buyers include assessing your family’s financial needs, comparing different policies to find the best coverage, and considering term vs. whole life insurance options. It’s also important to review and update your policy regularly, especially after major life events like marriage or the birth of a child.

How can life insurance help ensure my children’s future?

Life insurance can help ensure your children’s future by providing them with financial support in the event of your untimely passing. This coverage can pay for daily expenses, education costs, and even outstanding debts, ensuring that your children can continue to live comfortably and pursue their dreams without financial strain.

Why should I start thinking about life insurance now?

Thinking about life insurance now is essential because it allows you to secure coverage while you are healthy and premiums are lower. Additionally, starting early means you can customize a policy that fits your family’s unique needs and provides peace of mind knowing that you are taking steps to protect your loved ones.

How does Kelly Rowland promote life insurance awareness?

Kelly Rowland promotes life insurance awareness by sharing her personal experiences and emphasizing the importance of securing life insurance for families. As the spokesperson for Life Insurance Awareness Month, she encourages open conversations about life insurance, helping to change perceptions around the topic and highlight its role in ensuring peace of mind for families.

What should I consider when choosing a life insurance policy?

When choosing a life insurance policy, consider factors such as coverage amount, premium costs, policy term, and the financial stability of the insurance company. Assess your family’s needs, future financial obligations, and whether you prefer term or whole life insurance to find the best fit for your situation.

| Key Point | Details |

|---|---|

| Kelly Rowland’s Role | Spokesperson for Life Insurance Awareness Month (LIAM) to promote the importance of life insurance. |

| Personal Experience | Inspired by a friend’s loss, Kelly emphasizes the importance of life insurance for family security. |

| Life Insurance as Love | Kelly views life insurance as a way to express love and provide for her children’s future. |

| Changing the Stigma | Encourages open discussions about life insurance to alleviate fears and promote understanding. |

| Freedom from Worry | Having life insurance provides peace of mind and a sense of freedom from the burden of uncertainty. |

| Engagement and Resources | Kelly will share messages on social media and promote resources for understanding life insurance. |

Summary

Life insurance is essential for protecting the future of your loved ones. As Kelly Rowland highlights, it serves as a profound expression of love and commitment to your family’s well-being. By taking proactive steps in securing life insurance coverage, you not only ensure financial support for your family in unforeseen circumstances but also free yourself from the anxiety associated with the unknown. Start the conversation around life insurance today and empower your loved ones with the security they deserve.