Commercial General Liability Insurance: What You Need to Know

In today’s fast-paced business environment, having proper Commercial General Liability Insurance (CGL) is essential for safeguarding your enterprise against unexpected events. This type of liability insurance provides vital protection against claims of bodily injury, property damage, and personal injury that may occur during business operations. By incorporating CGL coverage into your business insurance policy, you not only ensure financial stability but also enhance your risk management for businesses. Understanding the intricacies of Commercial General Liability Insurance can be the key to mitigating potential threats that could jeopardize your company’s future. Whether you are a small startup or a large corporation, investing in comprehensive liability insurance types is a proactive step towards securing your business’s longevity.

Commercial General Liability Insurance, often abbreviated as CGL, is a critical component of any business’s insurance strategy. This insurance product, designed to shield enterprises from various claims, plays a significant role in the broader spectrum of business liability protections. By exploring alternative terms such as liability coverage and business protection plans, one can appreciate the multifaceted nature of risk management strategies available to companies today. As businesses face an array of potential challenges, understanding the diverse insurance options, including CGL policies, helps ensure comprehensive coverage against unforeseen liabilities. Ultimately, investing in robust liability insurance types is a strategic move that reinforces a company’s resilience in a competitive marketplace.

Understanding the Basics of Commercial General Liability Insurance

Commercial General Liability Insurance (CGL) serves as an essential safety net for businesses, protecting them against various liabilities that can arise during the course of operations. This type of liability insurance is designed to cover claims related to bodily injury, property damage, and personal injury caused by the business, its employees, or its products. As one of the primary types of business insurance policies, CGL coverage is crucial for entrepreneurs who want to safeguard their financial health against unforeseen accidents and legal challenges.

In today’s competitive landscape, having a solid understanding of CGL insurance is vital for effective risk management for businesses. It allows owners to focus on growth and operations without the looming fear of potential lawsuits. The coverage provided can alleviate the burden of legal costs and damages, ensuring that businesses can maintain their reputation and continue to operate smoothly even when faced with unexpected incidents. Thus, understanding and investing in commercial general liability insurance is a strategic move for any serious entrepreneur.

Exploring Territorial Coverage in CGL Policies

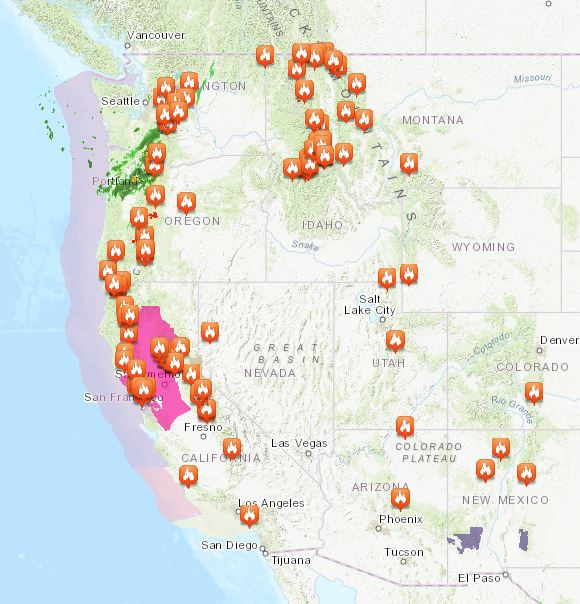

Territorial coverage is a significant aspect of commercial general liability insurance that business owners must understand. Typically, CGL policies cover incidents that occur within the geographical boundaries of the business’s operational site. However, the complexity of business activities often leads to situations where incidents occur off-site, raising questions about the extent of coverage. For instance, if a business representative is attending a conference and causes accidental damage, the question arises: is this covered under the existing CGL policy?

To ensure comprehensive protection, many CGL policies include provisions that extend coverage beyond the business premises. This means that if an incident occurs during a business-related event, such as a trade show or client meeting, the policy may still provide coverage. Understanding these nuances in territorial coverage is essential for businesses that frequently operate off-site or engage in activities that involve travel. By grasping the geographical limitations of their CGL coverage, business owners can make informed decisions about their insurance needs.

The Broad Scope of Coverage Beyond Business Premises

While commercial general liability insurance is primarily designed to cover on-site incidents, its scope often extends to off-site events related directly to business operations. This aspect of CGL coverage is crucial for businesses that engage in various activities outside their physical locations. For example, if a company hosts an event or participates in a public exhibition, any potential mishaps that occur during these events might still fall under the protection of their CGL policy.

This broad scope of coverage can significantly enhance a business’s risk management strategy, allowing companies to engage in promotional activities or networking opportunities without the constant worry of legal liabilities. However, business owners must carefully review their CGL policies to fully understand the conditions under which off-site incidents are covered. Clear communication with insurance providers can help ensure that businesses are adequately protected during off-site operations.

Identifying Limitations and Exclusions of CGL Insurance

While commercial general liability insurance provides essential coverage, it is crucial for businesses to recognize the limitations and exclusions that may apply. Not all incidents will be covered under a standard CGL policy, and certain exclusions can leave businesses vulnerable. For instance, many policies do not cover intentional acts, professional errors, or certain types of contractual liabilities. Understanding these limitations is vital for business owners to prevent unexpected gaps in coverage.

Additionally, businesses that operate internationally or engage in activities that fall outside the typical scope of operations need to be particularly mindful of potential exclusions. Some CGL policies may restrict coverage for incidents occurring outside the country or specific high-risk activities. By being aware of these limitations, business owners can take proactive steps to tailor their insurance coverage or seek additional policies that address unique risks associated with their operations.

Tailoring Commercial General Liability Insurance to Business Needs

Every business has its unique set of risks, and tailoring commercial general liability insurance to meet those specific needs is essential for effective coverage. When businesses engage with insurance providers, it is important to discuss the unique circumstances and potential liabilities they face. This collaborative approach allows for a customized insurance policy that provides adequate protection against the specific risks associated with the business’s operations.

By working closely with an experienced insurance agent, businesses can ensure that their CGL policy includes necessary endorsements or additional coverage options that align with their operational activities. This may include extending coverage for off-site events, adding protection for product-related incidents, or accommodating specific industry-related risks. Tailoring CGL coverage not only enhances protection but also provides business owners with peace of mind as they navigate their entrepreneurial journey.

Navigating the Complexities of CGL Coverage

Understanding whether commercial general liability insurance covers you wherever you go can be complex. While CGL policies primarily protect against on-site incidents, the coverage can extend to off-site activities related to business operations, depending on the specific terms outlined in the policy. This complexity necessitates a thorough understanding of the policy’s language and conditions to ensure that businesses are adequately protected in various scenarios.

As the business landscape evolves, so do the risks associated with it. Recognizing that CGL coverage can be nuanced allows entrepreneurs to better navigate potential pitfalls. By engaging in proactive discussions with insurance providers and continuously evaluating their coverage, business owners can ensure they have a safety net that adapts to their changing operational needs. This strategic approach not only fortifies their defenses against unforeseen challenges but also reinforces their commitment to responsible business practices.

The Role of CGL Insurance in Risk Management Strategies

Commercial general liability insurance plays a pivotal role in the risk management strategies of businesses. By providing coverage for a range of liabilities, businesses can mitigate the financial impact of unforeseen events, allowing them to focus on growth and innovation. A well-structured CGL policy becomes an integral part of a comprehensive business insurance policy, addressing various risks that could otherwise threaten the stability of the enterprise.

Incorporating CGL coverage into an overall risk management strategy not only protects businesses from legal liabilities but also enhances their credibility with clients and stakeholders. Demonstrating a commitment to safeguarding against potential risks signals professionalism and reliability, which can be critical for attracting new customers and retaining existing ones. Therefore, understanding and effectively utilizing CGL insurance is essential for any business looking to thrive in a competitive environment.

Building Confidence with Custom CGL Solutions

Working with a knowledgeable insurance provider can empower business owners to navigate the complexities of commercial general liability insurance confidently. Customized CGL solutions can address the unique challenges faced by different industries, ensuring that businesses have the right level of protection. This personalized approach not only enhances coverage but also fosters long-term relationships based on trust and mutual understanding.

For businesses looking to secure comprehensive coverage at competitive rates, it’s essential to partner with an insurance provider that prioritizes their specific needs. By engaging in open dialogue about potential risks and coverage options, business owners can ensure they are well-equipped to handle any liabilities that may arise. Ultimately, tailored CGL solutions enable businesses to operate with confidence, knowing they have a robust safety net in place.

Conclusion: Securing Your Business with CGL Insurance

In conclusion, commercial general liability insurance is a critical component of a business’s risk management strategy. Understanding the nuances of coverage, including territorial limits and potential exclusions, is essential for entrepreneurs aiming to protect their investments. The ability to tailor CGL policies ensures that businesses can effectively address their unique risks while enhancing their operational resilience.

As businesses continue to navigate an increasingly dynamic landscape, having a reliable insurance partner like Abbate Insurance can make all the difference. With expert guidance and a commitment to finding competitive coverage rates, business owners can focus on their growth and innovation, confident that they have a strong safety net in place. Investing in comprehensive CGL coverage not only protects against unforeseen challenges but also reinforces the long-term viability of the business.

Frequently Asked Questions

What is commercial general liability insurance (CGL) and why is it important for businesses?

Commercial general liability insurance (CGL) is a vital business insurance policy designed to protect enterprises from financial losses due to bodily injury, property damage, or personal injury claims. It serves as a fundamental component of risk management for businesses, ensuring legal costs and settlements are covered, thereby safeguarding the financial health of an organization.

Does commercial general liability insurance cover incidents that occur outside my business premises?

Yes, commercial general liability insurance often extends coverage to incidents that happen off-site, as long as they are directly related to business operations. For instance, if a company representative causes an accident while attending a trade show, CGL coverage may apply.

What are the limitations and exclusions of commercial general liability insurance?

While commercial general liability insurance provides essential coverage, it does have limitations and exclusions. For example, certain policies may not cover incidents that occur outside the country or may exclude specific activities. Understanding these limitations is crucial for effective risk management for businesses.

How can businesses tailor their commercial general liability insurance to meet their specific needs?

To tailor commercial general liability insurance effectively, businesses should work closely with an experienced insurance provider. This ensures that the coverage aligns with the unique risks associated with the business, including activities that may occur off-site or in different jurisdictions.

Why is it necessary for businesses to understand the nuances of commercial general liability insurance?

Understanding the nuances of commercial general liability insurance is essential for businesses to ensure adequate protection against potential liabilities. This knowledge helps in identifying the right coverage options, recognizing limitations, and avoiding unexpected gaps in protection that could lead to financial strain.

Can I get commercial general liability insurance for my home-based business?

Yes, home-based businesses can obtain commercial general liability insurance. It is essential to ensure that the policy covers the specific risks associated with operating from home, such as client visits or product deliveries, to effectively manage liability risks.

What should I consider when choosing commercial general liability insurance providers?

When choosing a provider for commercial general liability insurance, consider their experience, customer reviews, coverage options, and the ability to tailor policies to your specific business needs. It’s also important to assess their claims process and support services.

Is commercial general liability insurance enough for my business, or do I need additional coverage?

While commercial general liability insurance is crucial, it may not cover all risks. Depending on your business activities, you might need additional liability insurance types, such as professional liability or product liability insurance, to ensure comprehensive risk management.

| Key Point | Description |

|---|---|

| Definition of CGL | A comprehensive policy that protects businesses from financial losses due to bodily injury, property damage, or personal injury claims. |

| Coverage Area | Primarily covers incidents on business premises but can extend to off-site events directly related to business operations. |

| Limitations | Not a blanket solution; certain exclusions may apply, particularly for activities outside the country or specific events. |

| Importance of Tailoring | Businesses should customize their CGL policies to reflect their unique risks, especially for off-site engagements. |

| Conclusion | Understanding the nuances of CGL insurance is essential for effective risk management. |

Summary

Commercial General Liability Insurance is a crucial aspect of business risk management that offers protection from various unforeseen events. It is essential for business owners to understand the scope of their coverage, including geographical limitations and specific exclusions. Tailoring the policy to fit the unique needs of the business ensures adequate protection, especially during off-site activities. By working with experienced insurance providers, businesses can navigate the complexities of their coverage and secure the best possible rates.