Cryptocurrency Insurance Coverage: Recent Legal Insights

In the evolving landscape of digital finance, cryptocurrency insurance coverage has become a crucial topic for investors and homeowners alike. As the popularity of digital assets surges, so does the risk of cryptocurrency theft, making it essential to understand how traditional homeowner’s insurance policies may or may not apply. Many individuals are unaware that typical property insurance might not provide adequate protection for their valuable cryptocurrencies, often leaving them vulnerable to economic losses. Recent legal rulings have highlighted the limitations of insurance claims related to digital currencies, emphasizing the need for tailored coverage solutions. Understanding the nuances of cryptocurrency insurance can help individuals safeguard their investments and ensure peace of mind in an increasingly digital world.

As the financial world adapts to the rise of virtual currencies, protection strategies for these assets have become a significant concern. Insurance coverage for digital currencies, often referred to as cryptocurrency insurance, addresses the vulnerabilities of electronic funds against theft and fraud. While many homeowners may expect their property insurance to cover these high-value assets, the reality is that standard homeowner’s policies frequently fall short in providing necessary protection. This disconnect between traditional insurance products and the unique nature of digital assets has prompted a reevaluation of how individuals can best secure their investments. Exploring alternative insurance solutions tailored for digital currencies is now more pertinent than ever for safeguarding one’s financial future.

Understanding Cryptocurrency Theft and Insurance Coverage

Cryptocurrency theft poses a significant risk for owners of digital assets, as traditional insurance policies often do not adequately cover these unique forms of property. The distinction between cryptocurrency being classified as a security or property can greatly impact the availability of insurance coverage. Homeowner’s insurance, typically designed to cover physical property, may fall short when it comes to protecting against losses incurred through digital theft. As highlighted by the Sedaghatpour case, the courts ruled that the digital nature of cryptocurrency does not equate to physical loss, further complicating the insurance landscape for crypto holders.

Many individuals who invest in cryptocurrencies may assume that their homeowner’s insurance would extend to cover losses from theft or hacking. However, as cases like Sedaghatpour v. Lemonade Insurance Co. illustrate, standard homeowner’s policies often contain sublimits for electronic funds, which can leave significant gaps in coverage. The key takeaway for cryptocurrency owners is to thoroughly review their insurance policies and understand the limitations that may apply to digital assets. Seeking specialized cryptocurrency insurance coverage may be necessary to ensure adequate protection against potential theft.

The Implications of Court Rulings on Digital Asset Insurance

Recent court rulings have shed light on how digital assets such as cryptocurrencies are treated under existing insurance policies. The consistent interpretation of ‘physical loss’ across various jurisdictions indicates that courts may not recognize the theft of digital currencies as a qualifying loss under traditional property insurance. This precedent raises concerns for individuals relying on standard homeowner’s insurance to cover their cryptocurrency holdings. As the legal landscape evolves, owners of digital assets must stay informed about how these rulings could affect their insurance claims in the event of theft.

Furthermore, the implications of these rulings extend beyond individual claims. Insurers are beginning to revise policy language to explicitly exclude coverage for losses related to electronic currency. This trend indicates a growing recognition of the unique challenges presented by cryptocurrency theft. As a result, property insurance policies may become less favorable for crypto owners. It is crucial for investors in digital assets to not only be aware of their existing coverage but also to explore dedicated cryptocurrency insurance options that can provide tailored protection against the risks associated with their investments.

The Rise of Cryptocurrency Insurance Coverage

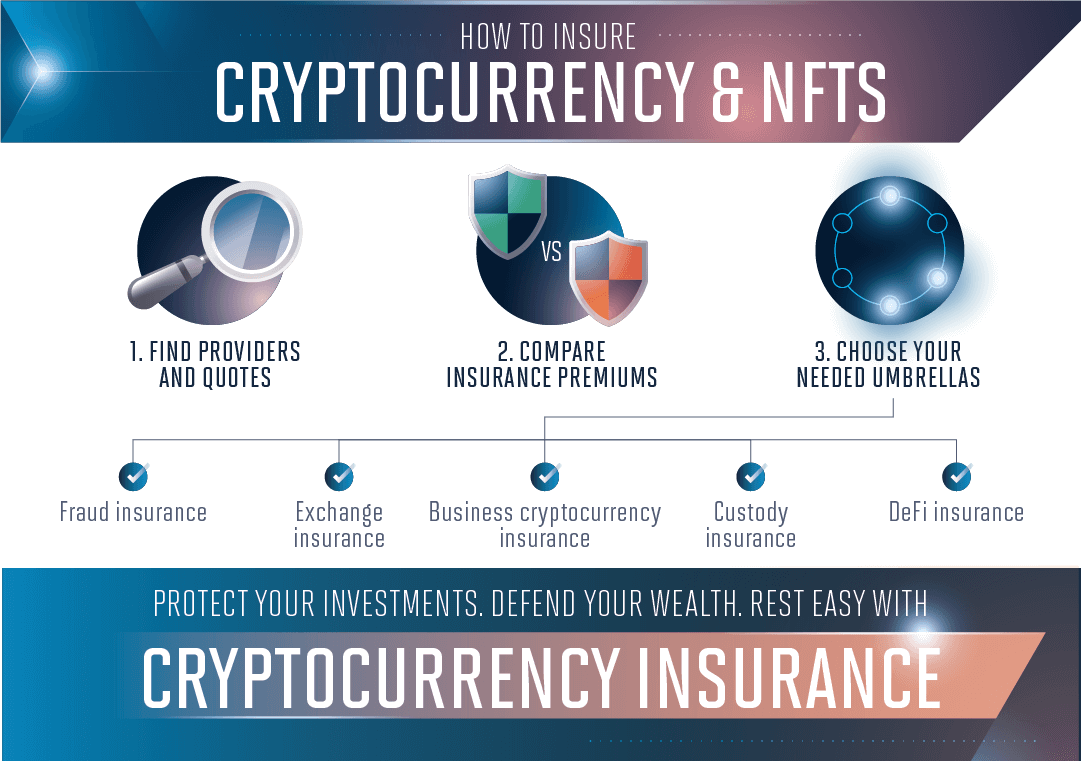

As the digital asset market continues to grow, so too does the demand for specialized cryptocurrency insurance coverage. Traditional insurance policies have struggled to adapt to the unique characteristics of digital currencies, leading to a gap in protection for investors. Cryptocurrency insurance is designed to address these concerns by providing coverage specifically tailored to the risks associated with owning and trading digital assets. This includes protection against theft, hacking, and other vulnerabilities that are prevalent in the crypto space.

In response to the increasing frequency of cryptocurrency theft, several insurers are now offering policies that cover a broader range of risks related to digital assets. These specialized policies often include provisions for theft, fraud, and even loss of access due to technical issues. By securing cryptocurrency insurance coverage, investors can mitigate their exposure to potential losses and ensure that their digital assets are adequately protected. As the market for digital currencies continues to evolve, it is essential for crypto investors to stay informed about the insurance options available to them.

Challenges with Homeowner’s Insurance for Digital Assets

Homeowner’s insurance policies traditionally cover physical property, leaving many cryptocurrency owners in a precarious situation when it comes to insuring their digital assets. The case of Sedaghatpour v. Lemonade Insurance Co. exemplifies the challenges faced when attempting to file insurance claims for stolen cryptocurrency. The courts determined that the theft of digital currency did not constitute a ‘physical loss,’ which meant that the homeowner’s insurance policy did not provide adequate coverage for the full extent of the loss incurred.

This decision reflects a broader trend in the insurance industry where digital assets are not recognized as being eligible for traditional property coverage. As a result, many homeowners may find themselves underinsured when it comes to protecting their cryptocurrency investments. It is vital for individuals to review their homeowner’s insurance policies and understand the limitations regarding digital asset coverage. Exploring additional options, such as cryptocurrency-specific insurance, can provide necessary protection against potential losses.

The Future of Insurance Claims for Cryptocurrency Losses

The future of insurance claims related to cryptocurrency losses remains uncertain as courts continue to grapple with how to classify digital assets. As more cases emerge, we may see a shift in how insurers approach coverage for cryptocurrency theft. The ongoing legal discourse surrounding the classification of cryptocurrencies as either securities or property will likely influence future insurance policies and the handling of claims. Investors need to stay abreast of these developments to understand their rights and options in the event of a loss.

Insurance companies are also likely to evolve their policies to address the growing concern of cryptocurrency theft. As awareness of the risks associated with digital assets increases, insurers may begin to offer more comprehensive coverage options tailored specifically for cryptocurrency owners. This evolution will be essential in providing peace of mind to investors who are currently navigating an uncertain landscape. Ultimately, the success of these insurance claims will hinge on the legal definitions and interpretations that emerge in the coming years.

Protecting Your Digital Assets from Theft

Protecting digital assets from theft is paramount for cryptocurrency owners, especially in light of recent court rulings that limit insurance coverage under traditional homeowner’s policies. Individuals need to implement robust security measures to safeguard their cryptocurrencies from potential hacks and theft. This includes utilizing hardware wallets, enabling two-factor authentication, and regularly updating security protocols to stay ahead of cybercriminals. By prioritizing security, investors can reduce the risk of loss and further minimize their reliance on insurance claims.

In addition to personal security measures, investors should also consider the importance of diversifying their cryptocurrency holdings across different wallets and platforms. This strategy not only helps in managing risk but also ensures that a single point of failure does not lead to catastrophic losses. While insurance can provide a safety net, proactive measures are critical in protecting digital assets. As the landscape of cryptocurrency continues to evolve, individuals must remain vigilant and informed about the best practices for safeguarding their investments.

The Importance of Understanding Insurance Policy Limits

Understanding the limits of insurance policies, particularly in relation to cryptocurrency theft, is essential for any digital asset owner. Many homeowners may be unaware that their standard insurance policies include sublimits on electronic funds or exclude coverage for digital currency theft altogether. In the case of Sedaghatpour, the homeowner received a mere $500 for his loss, highlighting the necessity of comprehending policy limitations. Owners of digital assets must proactively seek clarity on what their insurance covers and the extent of those limits.

Moreover, as the legal landscape surrounding cryptocurrency evolves, insurers may begin to adjust their policies accordingly. This could lead to changes in coverage terms and limits, emphasizing the importance of regularly reviewing insurance contracts. By staying informed about policy changes and understanding the terms, cryptocurrency owners can better prepare themselves for potential losses. Engaging with insurance professionals who specialize in digital asset coverage can also provide valuable insights and guidance in selecting the right policy to ensure adequate protection.

Legal Precedents Affecting Cryptocurrency Insurance

Legal precedents play a significant role in shaping the landscape of cryptocurrency insurance. The Sedaghatpour case serves as a landmark decision that could influence future rulings regarding the classification of digital assets in relation to traditional insurance policies. As courts continue to interpret the meaning of ‘physical loss’ in the context of cryptocurrency theft, their conclusions will set important precedents for how insurers handle claims. This evolving legal framework underscores the need for investors to remain vigilant and informed about their rights.

Additionally, as more cases are brought to court, we may witness the emergence of a clearer legal standard that can help guide insurance providers in crafting policies for digital assets. The outcome of these cases will not only affect individual claims but will also shape the overall insurance market for cryptocurrencies. Investors should keep abreast of these developments and consider consulting with legal experts to navigate the complexities of insurance coverage for their digital assets.

Future Trends in Cryptocurrency Insurance Policies

As the cryptocurrency market matures, we can expect to see significant trends emerging in insurance policies designed for digital assets. Insurers are beginning to recognize the need for specialized coverage that addresses the unique risks associated with cryptocurrency theft and loss. This may lead to the development of new policy structures that offer comprehensive protection for digital assets, including coverage for hacking events, fraud, and loss of access due to technical failures.

Furthermore, as the demand for cryptocurrency insurance increases, insurers may be compelled to innovate and create more competitive and tailored products. This could involve partnerships with cryptocurrency exchanges and wallets to offer integrated insurance solutions for investors. By embracing these trends, insurers can better meet the needs of cryptocurrency holders and provide essential protection in a rapidly changing digital landscape.

Frequently Asked Questions

What is cryptocurrency insurance coverage and how does it protect digital assets?

Cryptocurrency insurance coverage is designed to protect digital assets against risks such as theft, fraud, and loss. Unlike traditional property insurance, coverage for cryptocurrency can vary significantly, depending on the policy. Homeowner’s insurance may cover a limited amount for electronic funds, but often excludes full protection for cryptocurrency theft. It’s essential for cryptocurrency owners to understand the specifics of their insurance policies to ensure adequate coverage for their digital assets.

Does homeowner’s insurance cover cryptocurrency theft?

Homeowner’s insurance typically provides limited coverage for cryptocurrency theft. Most standard policies may only cover a small amount, often categorized under electronic funds, as seen in cases like Sedaghatpour v. Lemonade Insurance Co. where only a $500 limit was paid. Since many insurers explicitly exclude cryptocurrency from coverage, it’s crucial for individuals to verify their policy details and consider specialized cryptocurrency insurance for better protection.

How do insurance claims for cryptocurrency theft work?

Insurance claims for cryptocurrency theft generally follow the same process as traditional claims, but they can be complicated due to the nature of digital assets. When filing a claim, policyholders must demonstrate the loss and provide any necessary documentation, such as transaction histories. However, many insurers may deny claims based on the argument that cryptocurrencies do not constitute ‘physical’ loss, as highlighted in recent court rulings.

Are there any specific insurance policies for cryptocurrency and digital assets?

Yes, there are specialized insurance policies available for cryptocurrency and digital assets. These policies are tailored to cover the unique risks associated with digital currencies, including theft and hacking. Unlike standard homeowner’s insurance, these specialized policies can provide more comprehensive coverage, making them a wise choice for serious cryptocurrency investors.

What legal precedents exist regarding cryptocurrency insurance coverage?

Recent legal precedents, such as the Sedaghatpour case, have clarified that traditional homeowner’s insurance may not adequately cover cryptocurrency theft, as courts have ruled that digital assets do not meet the criteria for ‘physical’ loss. This reflects a broader trend where courts across the U.S. have consistently denied claims related to economic losses without structural damage, suggesting similar outcomes for future cryptocurrency insurance disputes.

How can cryptocurrency owners ensure proper insurance coverage for their digital assets?

To ensure proper insurance coverage for digital assets, cryptocurrency owners should thoroughly review their current homeowner’s insurance policies and look for any exclusions related to electronic currency. Additionally, they should consider acquiring specialized cryptocurrency insurance that explicitly covers theft, hacking, and other risks associated with digital assets, providing peace of mind and better financial protection.

What should I do if my homeowner’s insurance claim for cryptocurrency theft is denied?

If your homeowner’s insurance claim for cryptocurrency theft is denied, you should first review the denial letter to understand the insurer’s reasons. Consider seeking legal advice to explore your options, including the possibility of filing an appeal or pursuing litigation if you believe the denial was unjustified. Consulting with an attorney experienced in insurance claims can provide valuable insights and help you navigate the process.

| Key Point | Details |

|---|---|

| Insurance Coverage for Cryptocurrency Theft | The classification of cryptocurrency as either securities or property affects insurance coverage. |

| Court Rulings | Recent rulings indicate that digital theft does not constitute ‘physical’ loss, limiting coverage under homeowner’s policies. |

| Sedaghatpour v. Lemonade Insurance Co. | In this case, the court upheld that only a small amount ($500) was owed for the theft of cryptocurrency, as it was not considered a physical loss. |

| Implications for Owners | Homeowners should not rely on standard insurance policies for cryptocurrency coverage and need to take extra precautions to protect their digital assets. |

| Future Trends | Other courts may follow similar interpretations regarding the treatment of digital assets in insurance claims. |

Summary

Cryptocurrency insurance coverage is a complex issue influenced by recent legal rulings regarding the definition of physical loss. The courts have increasingly viewed the theft of digital assets as not qualifying for traditional insurance coverage, as seen in the Sedaghatpour case. This highlights the need for cryptocurrency owners to be proactive in protecting their assets, as standard homeowner’s insurance may not provide adequate coverage for theft or loss.