Flood Insurance: Essential Tips to Protect Your Property

Flood insurance is a vital aspect of safeguarding your home against the devastating effects of flooding. With climate change leading to unpredictable weather patterns, understanding what flood insurance is can help homeowners protect their properties from potential financial ruin. Unlike traditional homeowners insurance policies, flood insurance coverage is specifically designed to address damages caused by flooding events, making it an essential inclusion for anyone living in flood-prone areas. This blog will delve into the intricacies of flood insurance, exploring its coverage and providing essential flood insurance tips to ensure that your property is adequately protected. Join us as we uncover the key elements of flood damage prevention and the steps you can take to secure your home against this natural disaster.

When it comes to safeguarding your property, flood protection insurance plays a crucial role in mitigating risks associated with water damage. This specialized coverage is distinct from standard home insurance, offering tailored solutions for homeowners facing the threat of rising waters or heavy rainfall. Understanding the nuances of flood coverage can empower property owners to make informed decisions about their insurance needs. Additionally, adopting effective flood prevention strategies is essential for minimizing risks and ensuring the safety of your home. In this guide, we will explore various aspects of flood protection, including practical tips to enhance your property’s resilience against flooding.

Understanding Flood Insurance Basics

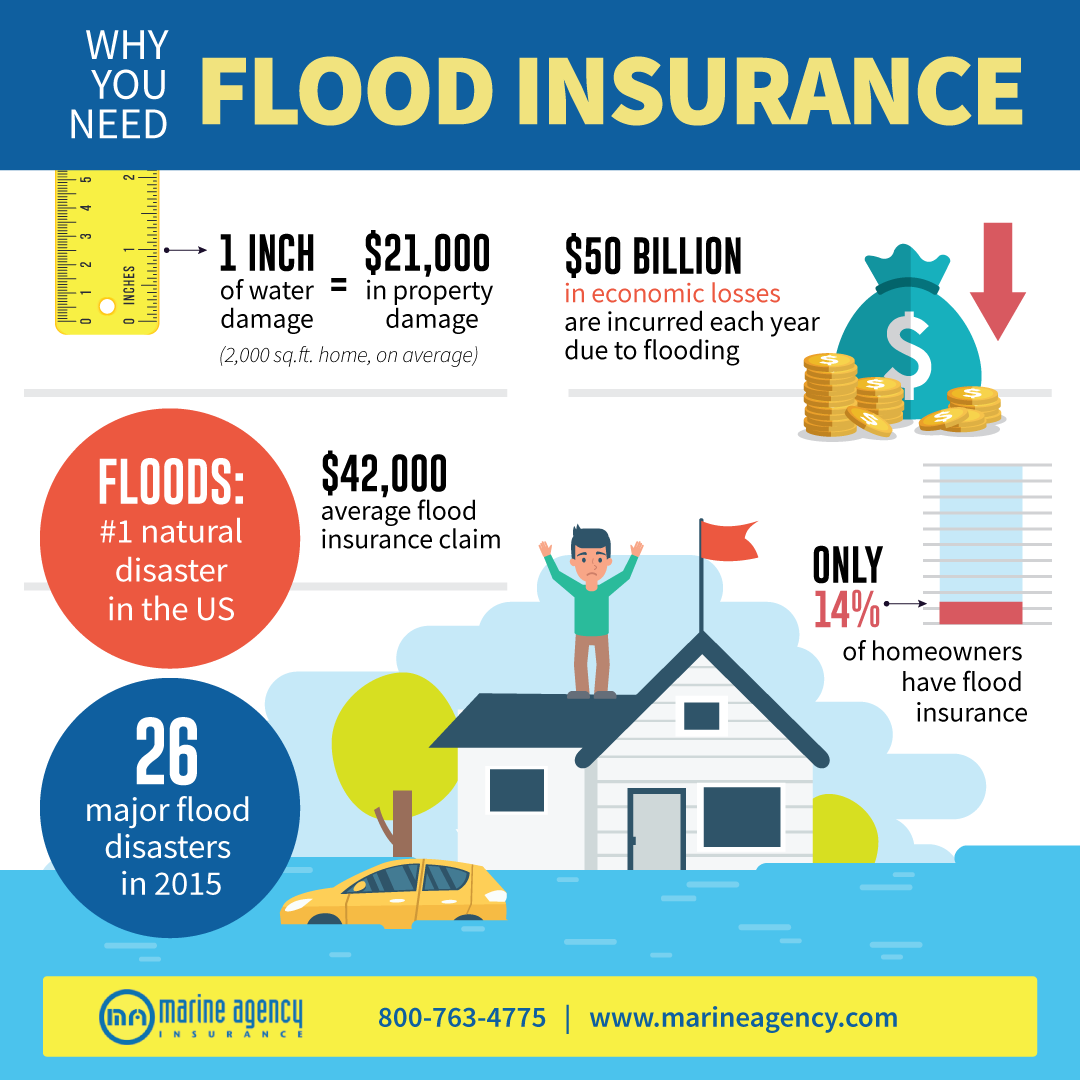

Flood insurance is essential for homeowners, especially those living in areas prone to flooding. It is a specific insurance policy that covers losses due to flooding, which is not included in standard homeowners insurance. This type of insurance provides financial protection against the damage caused by rising water levels, heavy rain, or storm surges. As climate change increases the unpredictability of weather patterns, understanding what flood insurance entails becomes crucial for homeowners in flood-prone regions.

When considering flood insurance, it’s important to know how it differs from other types of insurance. While homeowners insurance generally covers damage from fire, theft, and certain natural disasters, it typically excludes flooding. This gap in coverage highlights the need for homeowners to seek specialized flood insurance to ensure they are adequately protected against potential financial losses resulting from flood damage.

Comprehensive Coverage of Flood Insurance

Flood insurance offers comprehensive coverage that is vital for protecting both residential structures and personal property. This includes coverage for the building’s foundation, plumbing, electrical systems, and major appliances, as well as furniture and other personal belongings. Homeowners must familiarize themselves with the specifics of what their flood insurance policy covers to ensure they are fully aware of their protection against flood-related damages.

Understanding the limits and exclusions of flood insurance is equally important. Not all types of flooding are covered, and there may be waiting periods before the coverage takes effect. Additionally, certain high-risk areas may require mandatory flood insurance, while lower-risk areas may have optional coverage. Therefore, homeowners should consult with their insurance agents to tailor their policies according to their geographic risk and property value.

Key Tips for Flood Damage Prevention

Prevention is often the best strategy when it comes to protecting your property from floods. One of the first steps is to assess your risk by utilizing flood maps provided by the Federal Emergency Management Agency (FEMA). These maps can help you understand the flood zones in your area and guide you in determining the appropriate level of flood insurance coverage needed to safeguard your home.

Another critical tip for flood damage prevention is to invest in flood insurance as soon as possible. By working with a reputable insurance agent, you can select a comprehensive policy that covers both your property and personal belongings. The sooner you secure this insurance, the better prepared you will be to face any potential flooding scenarios.

Elevating Your Property Against Flood Risks

Elevating critical systems and components of your home is a proactive measure that can significantly reduce the risk of flood damage. By raising essential utilities such as HVAC units, electrical panels, and water heaters above potential flood levels, you can protect them from water damage. This simple step can save homeowners from costly repairs and disruptions during flood events.

In addition to elevating systems, it’s also important to consider the elevation of your entire property. If feasible, raising the foundation or using fill dirt to elevate your home can be effective strategies for minimizing flood risk. Homeowners should consult with local professionals to determine the best options for their specific circumstances.

Effective Landscaping for Flood Prevention

Landscaping plays a crucial role in flood prevention and can help redirect water away from your property. By modifying the grading of your yard, you can ensure that water flows away from your home rather than pooling around its foundation. Additionally, the strategic placement of plants and barriers can further enhance your landscape’s ability to absorb water and mitigate flood risks.

Using absorbent materials in your landscaping, such as rain gardens or swales, can also aid in flood prevention. These features help to capture and retain excess rainwater, reducing the amount that flows towards your home. By thoughtfully designing your outdoor space, you can significantly decrease the likelihood of flooding and protect your property from potential damage.

Creating an Emergency Preparedness Plan

An emergency preparedness plan is essential for any homeowner, particularly those living in flood-prone areas. This plan should include clear steps for evacuation, communication, and securing important documents in the event of a flood. Regularly practicing your emergency plan with family members ensures everyone knows what to do when a flood warning is issued, which can save lives and minimize panic.

In addition to evacuation plans, your emergency preparedness kit should include essential items such as medications, food, water, and important documents. Keeping this kit readily accessible will allow your family to respond quickly in case of an emergency. Staying prepared can provide peace of mind and significantly enhance your family’s safety during unexpected flood events.

Staying Informed About Flood Risks

Being informed about weather forecasts and flood alerts is a vital component of flood preparedness. Homeowners should utilize various resources, including local news channels, weather apps, and alerts from the National Weather Service, to stay updated on changing weather conditions. Early warning systems can provide crucial time to implement protective measures, such as moving valuables to higher ground or evacuating if necessary.

In addition to real-time updates, homeowners should familiarize themselves with seasonal weather patterns in their region. Understanding when flooding is most likely to occur can help you take proactive measures to protect your property. By staying informed, you can reduce risks and make timely decisions to safeguard your home and family from the impact of floods.

Tailored Flood Insurance Solutions

Finding the right flood insurance policy is essential for effective protection against flood damage. At Abbate Insurance Associates Inc., we specialize in offering customized flood insurance solutions that cater to the unique needs of each homeowner. Our experienced agents can help you navigate the complexities of flood insurance and ensure you have the appropriate coverage to protect your property.

By contacting us, you can discuss your specific requirements and explore the best options available for flood insurance. Our goal is to provide you with peace of mind, knowing that you are prepared for the unpredictable forces of nature. Don’t wait until it’s too late; secure your property with tailored flood insurance solutions today.

Frequently Asked Questions

What is flood insurance and why is it important?

Flood insurance is a specialized policy that protects property owners from financial losses due to flooding. It is crucial because standard homeowners insurance often does not cover flood-related damages, making flood insurance essential for those living in flood-prone areas.

What does flood insurance cover specifically?

Flood insurance typically covers damage to the structure of your property and its contents. This includes the foundation, plumbing, electrical systems, HVAC units, appliances, furniture, and personal belongings affected by floodwaters.

How can I protect my property from floods with insurance?

To protect your property from floods, invest in a comprehensive flood insurance policy that matches your risk level. Evaluate flood maps and work with a reputable insurance provider to ensure adequate coverage based on your property’s value and flood risk.

What are some flood insurance tips for homeowners?

Homeowners should assess their flood risk using FEMA flood maps, elevate critical systems above flood levels, seal vulnerable entry points, modify landscaping to redirect water, and stay informed about weather forecasts to effectively mitigate flood damage.

How does flood insurance differ from homeowners insurance?

Flood insurance is a separate policy specifically designed to cover damages caused by flooding, while homeowners insurance generally excludes flood damage. It’s essential for homeowners in flood-prone areas to obtain flood insurance in addition to their standard policy.

Can landscaping help in flood damage prevention?

Yes, effective landscaping can aid in flood damage prevention by directing water away from your property. Techniques like proper grading, strategic barriers, and using absorbent materials can significantly minimize the impact of floods.

What should I include in my emergency preparedness plan related to flood insurance?

Your emergency preparedness plan should include evacuation routes, access to emergency kits, copies of important documents, and a communication strategy for family members. This preparation can be crucial in the event of a flooding emergency.

How do I choose the right flood insurance coverage for my property?

Choosing the right flood insurance coverage involves assessing your property’s flood risk, understanding the value of your home and belongings, and consulting with an experienced insurance provider to determine the necessary coverage amount.

When is the best time to purchase flood insurance?

The best time to purchase flood insurance is before the flood season begins, as there is typically a 30-day waiting period before coverage takes effect. It’s advisable to secure your policy well in advance of potential flooding events.

How can I find tailored flood insurance solutions?

To find tailored flood insurance solutions, contact a specialized insurance agency like Abbate Insurance Associates Inc. They can provide personalized assistance based on your unique needs and circumstances regarding flood insurance.

| Key Points | Details |

|---|---|

| What is Flood Insurance? | A specialized insurance designed to protect property owners from financial losses due to flooding events. |

| Coverage | Covers property structure and contents, including foundation, electrical systems, appliances, and personal belongings. |

| 7 Tips to Protect Your Property | 1. Assess your risk using FEMA flood maps. 2. Invest in a comprehensive flood insurance policy. 3. Elevate critical systems above flood levels. 4. Seal vulnerable entry points to prevent water intrusion. 5. Modify landscaping to direct water away from the property. 6. Develop an emergency preparedness plan. 7. Stay informed about weather forecasts and flood alerts. |

| Contact for Flood Insurance Solutions | Abbate Insurance Associates Inc. offers tailored flood insurance solutions. Contact them at (203) 777-7229. |

Summary

Flood insurance is essential for homeowners seeking to protect their properties from the devastating effects of flooding. As climate change leads to more unpredictable weather, understanding what flood insurance covers and how to prepare is crucial. By being proactive and following the tips provided, homeowners can mitigate risks and ensure they are financially safeguarded against potential flood damage.