Food Truck Insurance: Essential Coverage for Owners

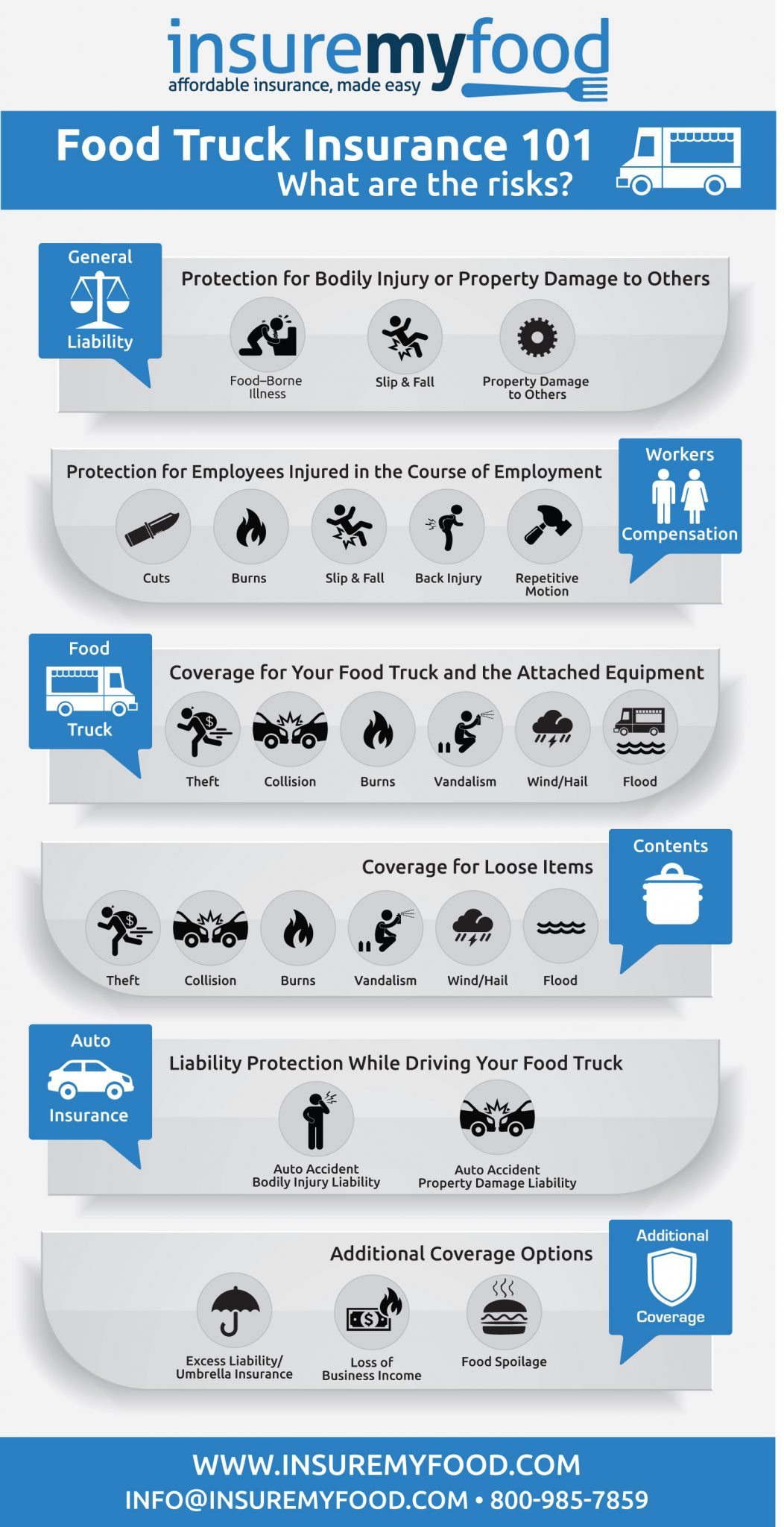

Food truck insurance is a vital consideration for mobile food entrepreneurs looking to protect their unique business model. With the challenges that come from operating on the go, including potential accidents, equipment failures, and food safety issues, having the right insurance coverage is essential. This specialized insurance not only includes food truck liability insurance to shield against personal injury claims, but also commercial auto insurance to safeguard the vehicle itself. Moreover, coverage such as workers’ compensation for food trucks ensures that employees are protected while on the job, while business interruption insurance helps maintain financial stability during unexpected closures. By understanding and investing in comprehensive food truck insurance, owners can focus on serving delicious meals without the looming fear of financial loss.

When it comes to safeguarding your mobile culinary venture, having the right coverage is crucial. Mobile food service providers face a myriad of risks, from accidents on the road to equipment breakdowns and foodborne illness claims. Comprehensive coverage options, often referred to as food cart insurance or mobile vendor insurance, encompass critical protections like general liability and commercial auto policies. Additionally, addressing employee safety through workers’ compensation and ensuring business continuity with business interruption insurance are essential components of any food truck owner’s risk management strategy. In this guide, we delve into the various types of insurance that can fortify your food truck business against unforeseen challenges.

Understanding Food Truck Insurance

Operating a food truck comes with its unique set of challenges, making food truck insurance an essential aspect of running this type of business. Food truck insurance encompasses various coverage options tailored to protect against the specific risks associated with mobile food service. From potential accidents on the road to equipment breakdowns and liability claims, having the right insurance coverage can significantly safeguard your investment and ensure business continuity.

The insurance landscape for food trucks includes several critical components, such as general liability insurance, commercial auto insurance, and workers’ compensation insurance. Understanding these types of coverage allows food truck owners to effectively manage risks and protect their assets. By investing in comprehensive food truck insurance, you not only comply with legal requirements but also gain peace of mind knowing that you are prepared for any unforeseen events that could disrupt your operations.

The Importance of General Liability Insurance for Food Trucks

General liability insurance is a cornerstone of food truck insurance, providing essential coverage for bodily injury, property damage, and personal injury claims arising from your operations. This type of insurance is particularly crucial for food trucks, which often operate in high-traffic areas where accidents can occur unexpectedly. For instance, if a customer trips over equipment outside your truck, general liability insurance can cover medical expenses and legal costs, protecting your business from potential lawsuits.

Moreover, general liability insurance also plays a vital role in maintaining your business reputation. A single incident can lead to negative publicity, severely impacting your customer base. By having adequate coverage, you not only protect your finances but also demonstrate to your customers that you prioritize safety and responsibility in your operations. This proactive approach can help foster trust and loyalty among your clientele.

Why Commercial Auto Insurance is Essential for Food Truck Operations

As a food truck owner, commercial auto insurance is crucial for protecting your vehicle during business operations. Personal auto insurance policies typically exclude coverage for commercial vehicles, leaving food truck operators vulnerable to significant financial losses in the event of an accident. Whether you are driving to a new location or parked at an event, commercial auto insurance provides essential protection against vehicle damage, liability claims, and injuries sustained during accidents.

In addition to covering accidents, commercial auto insurance ensures compliance with state regulations regarding commercial vehicle coverage. Failing to carry the proper insurance can result in hefty fines and legal troubles, further jeopardizing your business. By investing in commercial auto insurance, you not only protect your food truck but also align your operations with legal requirements, allowing you to focus on serving delicious food to your customers.

Protecting Your Food Truck with Workers’ Compensation Insurance

Workers’ compensation insurance is a legal necessity for food truck businesses that employ staff. This coverage protects employees by providing medical benefits and wage replacement in cases of work-related injuries. For food truck operators, the risk of accidents is ever-present, from slips and falls to burns from hot equipment. Without workers’ compensation insurance, you could face significant financial burdens related to employee injuries, including medical costs and potential lawsuits.

Furthermore, workers’ compensation insurance fosters a safe working environment by encouraging businesses to implement safety protocols. When employees know they are protected, they may feel more secure and valued, leading to improved morale and productivity. By prioritizing your employees’ well-being through comprehensive coverage, you not only comply with legal requirements but also create a positive workplace culture that can enhance your business’s overall success.

Understanding Product Liability Insurance for Food Trucks

Product liability insurance is vital for food truck owners, as it protects against claims related to foodborne illnesses or allergic reactions. If a customer becomes ill after consuming your food, product liability insurance can cover medical expenses, legal fees, and settlements, which can be substantial. This type of coverage helps mitigate the financial risks associated with serving food, allowing you to focus on delivering quality meals to your customers without the fear of a costly lawsuit.

Moreover, having product liability insurance can enhance your business’s credibility. Customers are more likely to trust a food truck that demonstrates responsibility in protecting its patrons. By being proactive and obtaining product liability coverage, you show your commitment to food safety and customer care, which can lead to increased customer loyalty and a positive reputation in the competitive food truck industry.

The Role of Business Interruption Insurance in Food Truck Success

Business interruption insurance is an essential component of a food truck’s insurance portfolio, providing coverage for lost income during unforeseen disruptions. Whether due to equipment breakdown, accident, or severe weather, a food truck’s ability to generate revenue can be significantly affected. This type of insurance helps bridge the financial gap, ensuring that your business remains stable while you recover and get back on the road.

In addition to covering lost income, business interruption insurance can also help with ongoing expenses such as rent, utilities, and payroll during periods of inactivity. This financial cushion allows food truck owners to focus on repairs and recovery without the added stress of mounting bills. By securing business interruption insurance, you are investing in your food truck’s long-term success and resilience against unexpected challenges.

Equipment Breakdown Insurance: Safeguarding Your Food Truck Operations

Equipment breakdown insurance is an often-overlooked aspect of food truck insurance that protects against the financial consequences of mechanical or electrical failures. Food trucks rely heavily on specialized equipment such as grills, fryers, and refrigerators, which are essential for daily operations. When this equipment malfunctions, the costs of repairs and potential income loss can be devastating without proper coverage.

By investing in equipment breakdown insurance, food truck owners can minimize downtime and reduce the financial impact of unexpected equipment failures. This coverage not only helps with repair costs but can also compensate for lost income during the downtime. With equipment breakdown insurance, you can focus on serving your customers with confidence, knowing that your business is protected against unforeseen operational hurdles.

Cyber Suite: Protecting Your Food Truck from Digital Threats

In today’s digital age, food trucks are increasingly reliant on technology for transactions, making them vulnerable to cyberattacks. Cyber Suite insurance is designed to protect your business from the financial fallout of data breaches, hacking incidents, and other cyber-related threats. As more food trucks utilize point-of-sale systems and mobile payment apps, this type of coverage becomes essential for safeguarding sensitive customer information.

Having a Cyber Suite policy in place not only covers expenses related to data breaches, such as customer notification and monitoring, but also helps with recovery costs after an attack. This proactive approach to cybersecurity can protect your business reputation, ensuring that you respond effectively to incidents and maintain customer trust. By prioritizing cyber liability insurance, you demonstrate to your customers that you take their privacy seriously and are committed to protecting their information.

Inland Marine Insurance: Protecting Your Equipment on the Move

Inland marine insurance is a critical coverage option for food trucks that transport expensive equipment between locations. This type of insurance protects against damage, loss, or theft of your essential cooking tools and inventory while they are in transit or temporarily stored. Given the nature of food truck operations, having inland marine insurance can prevent significant financial setbacks caused by unforeseen incidents during transportation.

For food truck owners, inland marine insurance provides peace of mind, knowing that their valuable equipment is protected no matter where it is located. This coverage ensures that you can continue providing services without worrying about the financial impact of lost or damaged equipment. By incorporating inland marine insurance into your food truck insurance portfolio, you strengthen your business’s resilience and operational efficiency.

Why Umbrella Insurance is a Smart Investment for Food Truck Owners

Umbrella insurance serves as an additional layer of protection for food truck owners, extending the limits of your existing liability policies. This coverage is particularly important for food trucks that operate in busy locations or events where liability risks are heightened. With umbrella insurance, you can safeguard your business against large claims that exceed your general liability or commercial auto insurance limits, protecting your assets and financial stability.

Investing in umbrella insurance also provides peace of mind, knowing that you have a safety net should an unexpected incident occur. For instance, if your food truck is involved in a serious accident resulting in multiple claims, umbrella insurance can cover the excess costs, preventing potential financial ruin. By incorporating umbrella insurance into your overall risk management strategy, you equip your food truck business with comprehensive protection against a wide range of liabilities.

Frequently Asked Questions

What is food truck liability insurance and why do I need it?

Food truck liability insurance is a crucial coverage that protects your business from claims related to bodily injury, property damage, and personal injury resulting from your operations. It is essential for safeguarding your finances and reputation, especially in busy locations where accidents can happen unexpectedly.

How does commercial auto insurance benefit my food truck business?

Commercial auto insurance is vital for food truck owners, as personal auto policies do not cover vehicles used for business. This insurance protects you from accidents, vehicle repairs, and third-party damages while driving to events or when parked, ensuring compliance with state regulations.

What does workers’ compensation for food trucks cover?

Workers’ compensation insurance is essential for food truck operators with employees. It covers medical expenses and lost wages for workers injured on the job, protecting your business from potential lawsuits related to workplace injuries.

Why is business interruption insurance important for food truck owners?

Business interruption insurance is critical as it covers lost income during unexpected disruptions, such as equipment breakdowns or severe weather. This insurance helps maintain your financial stability while you recover and get back to serving customers.

What is equipment breakdown insurance and how does it help food trucks?

Equipment breakdown insurance protects food truck operators from the financial impact of mechanical or electrical failures. It covers repair or replacement costs for essential equipment like grills and refrigerators, minimizing downtime and ensuring you can quickly resume operations.

Can product liability insurance protect my food truck from foodborne illness claims?

Yes, product liability insurance is designed to protect food truck owners from claims related to foodborne illnesses or allergic reactions. It covers medical costs, legal fees, and settlements, providing peace of mind when serving food to customers.

What does commercial property insurance cover for my food truck?

Commercial property insurance covers the cost of repairing or replacing expensive equipment in your food truck, such as grills and refrigeration units, in case of damage from theft, fire, or vandalism, ensuring your operations can continue without significant financial loss.

How can cyber liability insurance protect my food truck business?

Cyber liability insurance is increasingly important for food trucks that use digital payment systems. It covers expenses related to data breaches, including customer notification and recovery costs, protecting your business from the fallout of cyberattacks.

What is inland marine insurance and why do I need it for my food truck?

Inland marine insurance protects your valuable equipment while in transit or temporarily stored away from your food truck. This coverage is essential for safeguarding items like grills and fryers from damage or theft during transport, ensuring your operations remain uninterrupted.

How does umbrella insurance provide additional protection for food trucks?

Umbrella insurance extends the limits of your existing liability policies, offering extra financial protection against large claims or lawsuits that exceed your policy limits. It is especially useful for food truck owners who operate in high-traffic areas, safeguarding your assets effectively.

| Insurance Type | Importance | Examples |

|---|---|---|

| General Liability Insurance | Covers third-party injuries and property damage claims, protecting reputation and finances. | Covers medical expenses for a customer injured by your truck. |

| Commercial Auto Insurance | Covers accidents, vehicle repairs, and third-party damage while operating. | Covers repairs after rear-ending another vehicle. |

| Commercial Property Insurance | Protects critical equipment and helps recover quickly from damage. | Covers damages from a kitchen fire affecting your equipment. |

| Workers’ Compensation Insurance | Covers medical expenses and lost wages for employee injuries. | Covers medical bills for an employee injured while cooking. |

| Product Liability Insurance | Protects against claims related to foodborne illnesses or allergic reactions. | Covers medical expenses if a customer reports food poisoning. |

| Business Interruption Insurance | Covers lost income during operational disruptions. | Covers income loss if your truck is damaged by a storm. |

| Equipment Breakdown | Covers repair or replacement costs for damaged equipment. | Covers costs when your generator fails, impacting operations. |

| Cyber Suite | Covers expenses related to data breaches and cyberattacks. | Covers costs if your POS system is hacked. |

| Inland Marine | Protects equipment while in transit or temporarily stored. | Covers damages to your generator while transporting to an event. |

| Umbrella Insurance | Adds additional financial protection for large claims. | Covers costs exceeding your auto policy limits in an accident. |

Summary

Food truck insurance is essential for safeguarding your mobile business against various risks. From general liability and commercial auto coverage to protection against equipment breakdown and cyber incidents, each type of insurance plays a crucial role in ensuring your operations run smoothly. By investing in comprehensive food truck insurance, you not only protect your equipment and employees but also maintain your business’s reputation and financial stability in the face of unexpected challenges.